New Zealand Awaits Rate Hike Decision Amid Cyclone Emergency

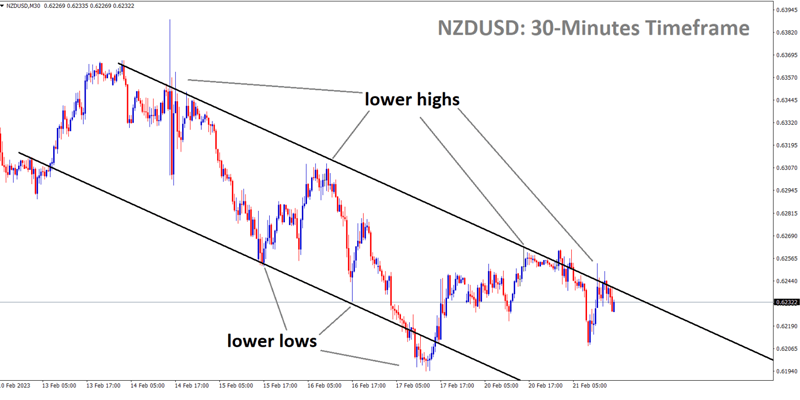

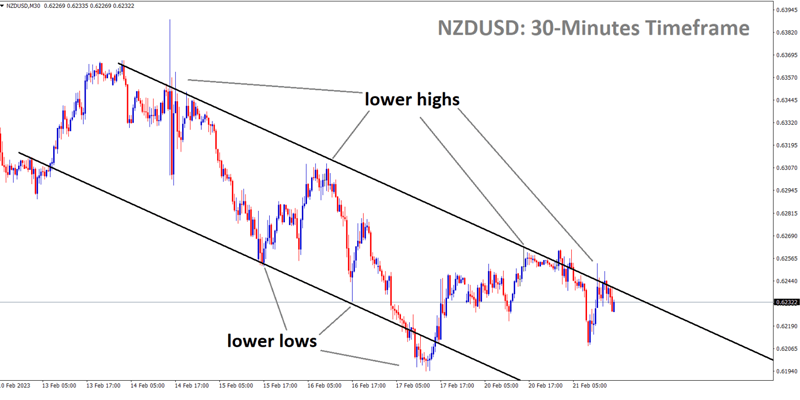

NZDUSD is moving in the Descending channel and the market has fallen from the lower high area of the channel.

The approaching RBNZ governing board meeting is already the primary focus of the market analysts’ attention. It is anticipated that the board will make an announcement about its decision on interest rates and monetary policy.

There is a consensus among economists that the Reserve Bank of New Zealand (RBNZ) would probably raise interest rates on loans, but they cannot agree on how much. Some forecast a rise of 25 basis points, while others anticipate a rise of 50 basis points.

New Zealand Cyclone Damage

On Monday, New Zealand issued a warning that the final cost of the devastating cyclone Gabrielle, which has left at least 11 people dead and has caused at least $8 billion in damage, could rise above $8 billion. At the same time, authorities announced emergency funding to assist in the recovery efforts.

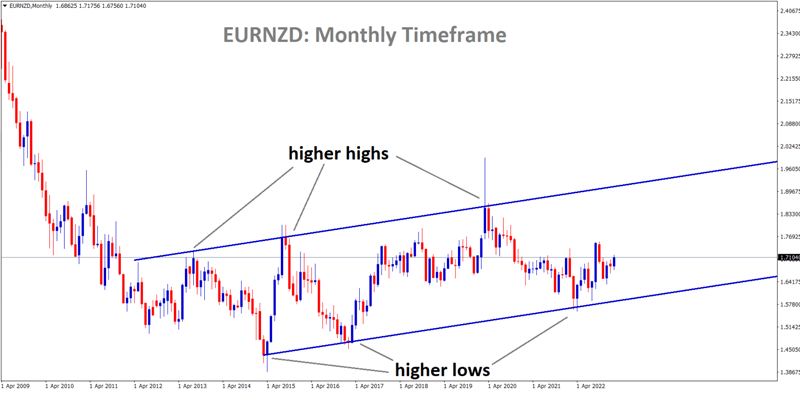

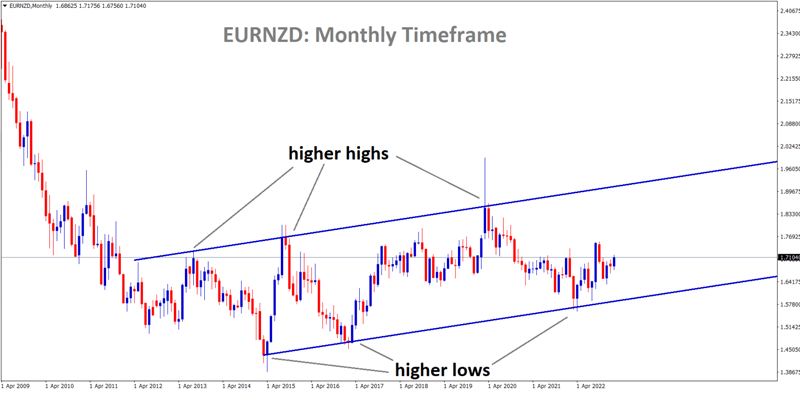

EURNZD is moving in Ascending channel and the market is rebounded from the higher low area of the channel.

On February 12, the eye of the cyclone struck the most northern part of the North Island, and as it moved south down the east coast, it caused significant devastation. Gabrielle has been described by New Zealand’s Prime Minister, Chris Hopkins, as the country’s most catastrophic natural catastrophe of this century.

Heavy rain is expected to begin falling on Thursday in the hard-hit parts of the northeast, where 13,000 people still do not have electricity and 1,300 are taking refuge in emergency shelters. The meteorological authority Met service issued a warning that there was a likelihood of nearly one in two hazardous levels dropping on Friday and Saturday.

Severe weather has returned to devastated districts like Hawke’s Bay and Gisborne as the police continue their search for about 1,100 persons who are still classified as being uncontactable. After all, communications have been fully restored. According to statements made by the police on Monday, they anticipate the great majority will report that they are safe.

Interest Rate Forecasts

As a result of data suggesting that inflation has reached its maximum level and in the wake of Cyclone Gabrielle’s widespread destruction, the Reserve Bank of New Zealand is planning to slow the rate at which it is increasing interest rates by a quarter of a percentage point on Wednesday.

At its first meeting of the year, the Reserve Bank is expected to increase the Official Cash Rate from its current level of 4.25% to 4.75%, according to 19 of 23 economists surveyed. When the RBNZ increased the benchmark interest rate by that amount at its most recent meeting, three economists believed that the RBNZ would increase it by another 75 basis points. At the same time, one forecasted a quarter-point shift, and another saw no change.

GBPNZD is moving in an Ascending channel and the market has reached the higher high area of the channel

A less significant increase in rates would move the Reserve Bank of New Zealand (RBNZ) closer to its global peers, which have moderated the pace of tightening as rate-sensitive parts of their economy have slowed. Notwithstanding this, a change of 0.5 points would place New Zealand at the top end of the gains seen in previous years.

The Federal Reserve hiked interest rates by a quarter of a point earlier this month, marking a slowdown from the previous month’s increase of fifty basis points and the four straight hikes of seventy-five basis points that came before that.

After having pondered taking a break in December, the Reserve Bank of Australia (RBA) changed its policy in February, becoming more hawkish than it had been since October when it switched from half-point to quarter-point adjustments.

Around two o’clock in the afternoon, the Reserve Bank of New Zealand (RBNZ) will announce its decision, and Governor Adrian Orr will attend a news conference in an hour. A fresh set of projections, including an outlook for the OCR’s future path, will be presented in the bank’s upcoming quarterly Monetary Policy Statement.

New Zealand Wage Crisis

The unemployment rate in New Zealand increased to 3.4% in the last quarter of 2022, despite the fact that earnings increased even as the labor force participation rate and the employment rate remained at their greatest levels ever. From the September 2021 quarter, data from Statistics New Zealand shows that the unemployment rate has been at or around historic lows.

NZDJPY is moving in the Symmetrical triangle pattern and the market has fallen from the top area of the pattern.

This trend has continued since the previous quarter. Because of rises in the number of people who are capable of working, the underutilization rate, also known as the measurement of unused labor capacity, rose to 9.4 percent.

The number of people who were absent from their jobs or worked fewer hours as a direct result of COVID-19 decreased by 146,200 annually. However, this decrease was partially offset by an increase in the number of people who were absent due to their own illness or injury or because they were on vacation.

According to the study, yearly salary and pay rates reached their highest level since 1992, with a growth of 4.1% in the December quarter across all salary and compensation rates (including overtime). In the year leading up to the December 2022 quarter, the average weekly earnings of employees working full-time equivalent hours climbed by 7.6%. The average hourly earnings of employees working ordinary time increased by 7.2% to reach $38.19.

RBNZ Or Speech

RBNZ governor Adrian Orr recently gave a speech where he discussed the financial expenditures of the previous year and his plans moving forward. He reveals, “In response to the most recent IMF Financial Sector Assessment Program review, we are building a more intensive approach to prudential supervision while also building strong and productive relationships with stakeholders. That said, financial institutions will need to continue investing in their systems, governance, and risk management to build their long-term resilience.”

AUDNZD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

“We have made continued good progress on our transformation as set out in the five-year funding agreement. However, there is much more to be done, especially as we build for the new Deposit Takers Act. I am very proud of and thankful for our new governance arrangements and Board, the Monetary Policy Committee, our Leadership team, and all of our people. It has been a year of considerable commitment, effort, and determination in supporting all New Zealanders during a very challenging year.”

New Zealand Awaits Rate Hike Decision Amid Cyclone Emergency

NZDUSD is moving in the Descending channel and the market has fallen from the lower high area of the channel.

The approaching RBNZ governing board meeting is already the primary focus of the market analysts’ attention. It is anticipated that the board will make an announcement about its decision on interest rates and monetary policy.

There is a consensus among economists that the Reserve Bank of New Zealand (RBNZ) would probably raise interest rates on loans, but they cannot agree on how much. Some forecast a rise of 25 basis points, while others anticipate a rise of 50 basis points.

New Zealand Cyclone Damage

On Monday, New Zealand issued a warning that the final cost of the devastating cyclone Gabrielle, which has left at least 11 people dead and has caused at least $8 billion in damage, could rise above $8 billion. At the same time, authorities announced emergency funding to assist in the recovery efforts.

EURNZD is moving in Ascending channel and the market is rebounded from the higher low area of the channel.

On February 12, the eye of the cyclone struck the most northern part of the North Island, and as it moved south down the east coast, it caused significant devastation. Gabrielle has been described by New Zealand’s Prime Minister, Chris Hopkins, as the country’s most catastrophic natural catastrophe of this century.

Heavy rain is expected to begin falling on Thursday in the hard-hit parts of the northeast, where 13,000 people still do not have electricity and 1,300 are taking refuge in emergency shelters. The meteorological authority Met service issued a warning that there was a likelihood of nearly one in two hazardous levels dropping on Friday and Saturday.

Severe weather has returned to devastated districts like Hawke’s Bay and Gisborne as the police continue their search for about 1,100 persons who are still classified as being uncontactable. After all, communications have been fully restored. According to statements made by the police on Monday, they anticipate the great majority will report that they are safe.

Interest Rate Forecasts

As a result of data suggesting that inflation has reached its maximum level and in the wake of Cyclone Gabrielle’s widespread destruction, the Reserve Bank of New Zealand is planning to slow the rate at which it is increasing interest rates by a quarter of a percentage point on Wednesday.

At its first meeting of the year, the Reserve Bank is expected to increase the Official Cash Rate from its current level of 4.25% to 4.75%, according to 19 of 23 economists surveyed. When the RBNZ increased the benchmark interest rate by that amount at its most recent meeting, three economists believed that the RBNZ would increase it by another 75 basis points. At the same time, one forecasted a quarter-point shift, and another saw no change.

GBPNZD is moving in an Ascending channel and the market has reached the higher high area of the channel

A less significant increase in rates would move the Reserve Bank of New Zealand (RBNZ) closer to its global peers, which have moderated the pace of tightening as rate-sensitive parts of their economy have slowed. Notwithstanding this, a change of 0.5 points would place New Zealand at the top end of the gains seen in previous years.

The Federal Reserve hiked interest rates by a quarter of a point earlier this month, marking a slowdown from the previous month’s increase of fifty basis points and the four straight hikes of seventy-five basis points that came before that.

After having pondered taking a break in December, the Reserve Bank of Australia (RBA) changed its policy in February, becoming more hawkish than it had been since October when it switched from half-point to quarter-point adjustments.

Around two o’clock in the afternoon, the Reserve Bank of New Zealand (RBNZ) will announce its decision, and Governor Adrian Orr will attend a news conference in an hour. A fresh set of projections, including an outlook for the OCR’s future path, will be presented in the bank’s upcoming quarterly Monetary Policy Statement.

New Zealand Wage Crisis

The unemployment rate in New Zealand increased to 3.4% in the last quarter of 2022, despite the fact that earnings increased even as the labor force participation rate and the employment rate remained at their greatest levels ever. From the September 2021 quarter, data from Statistics New Zealand shows that the unemployment rate has been at or around historic lows.

NZDJPY is moving in the Symmetrical triangle pattern and the market has fallen from the top area of the pattern.

This trend has continued since the previous quarter. Because of rises in the number of people who are capable of working, the underutilization rate, also known as the measurement of unused labor capacity, rose to 9.4 percent.

The number of people who were absent from their jobs or worked fewer hours as a direct result of COVID-19 decreased by 146,200 annually. However, this decrease was partially offset by an increase in the number of people who were absent due to their own illness or injury or because they were on vacation.

According to the study, yearly salary and pay rates reached their highest level since 1992, with a growth of 4.1% in the December quarter across all salary and compensation rates (including overtime). In the year leading up to the December 2022 quarter, the average weekly earnings of employees working full-time equivalent hours climbed by 7.6%. The average hourly earnings of employees working ordinary time increased by 7.2% to reach $38.19.

RBNZ Or Speech

RBNZ governor Adrian Orr recently gave a speech where he discussed the financial expenditures of the previous year and his plans moving forward. He reveals, “In response to the most recent IMF Financial Sector Assessment Program review, we are building a more intensive approach to prudential supervision while also building strong and productive relationships with stakeholders. That said, financial institutions will need to continue investing in their systems, governance, and risk management to build their long-term resilience.”

AUDNZD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

“We have made continued good progress on our transformation as set out in the five-year funding agreement. However, there is much more to be done, especially as we build for the new Deposit Takers Act. I am very proud of and thankful for our new governance arrangements and Board, the Monetary Policy Committee, our Leadership team, and all of our people. It has been a year of considerable commitment, effort, and determination in supporting all New Zealanders during a very challenging year.”