Geopolitical Tensions To Impact Upcoming US GDP Data

XAUUSD is moving in the Descending channel and the market has fallen from the lower high area of the channel.

In 2022, above-average inflation wiped at least 4 percentage points off of government debt in advanced countries and over 1 percentage point in EMDEs. This occurred at a time when inflation was soaring and GDP was coming to a standstill.

In contrast, the impact of growth that was above average in both advanced economies and EMDEs was essentially nonexistent. Hence, inflation will lower the debt-to-GDP ratio for advanced nations by about 6 percentage points of GDP during the period of two years beginning in 2020 and ending in 2022, while economic growth will have around half of the impact.

Above-average inflation and growth contributed to a reduction in debt-to-GDP ratios of more than 4 percentage points for EMDEs that did not include China, Russia, or Ukraine. Inflation was responsible for almost 3 percentage points of GDP decline, and growth was responsible for more than 1 percentage point of GDP decline.

The upcoming GDP data from the United States will further reveal how inflation and the geopolitical tensions around the world have impacted the nation.

US-China Trade War

In spite of the deterioration in diplomatic ties between the two countries in 2018, the volume of trade between the United States and China reached an all-time high. In 2022, the combined value of the two countries’ imports and exports was $690.6 billion. The latest incident with a Chinese balloon that flew across the United States has brought tensions between the two nations to new heights.

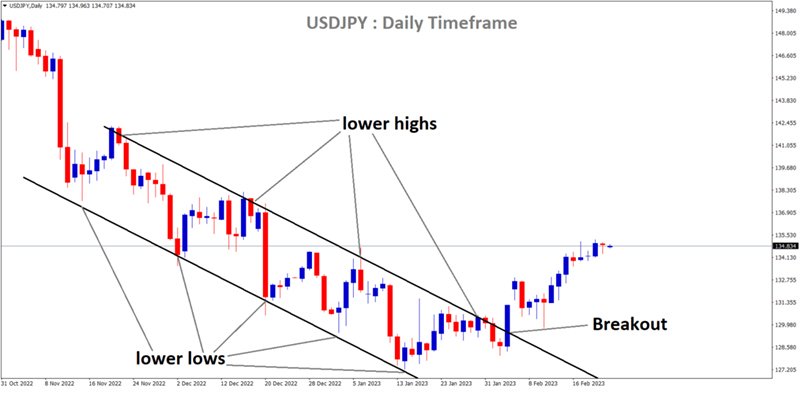

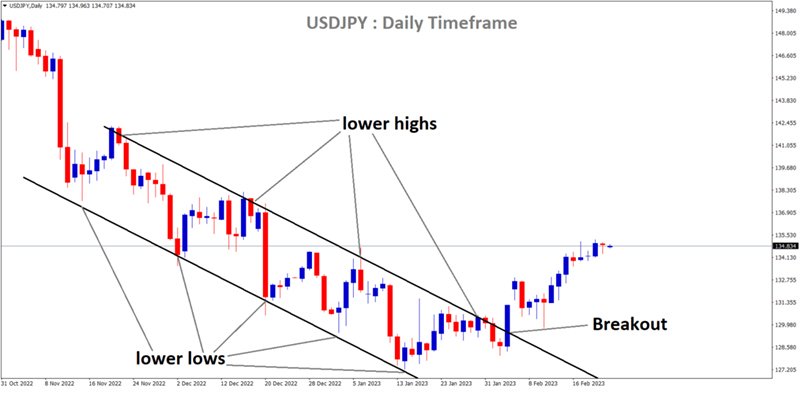

USDJPY has broken the Descending channel in Upside.

Beijing refutes allegations made by the United States that it was used for spying. A trade war has been going on between the world’s two largest economies, the United States and China, since 2018. As a result of increasing spending by American consumers on products manufactured in China, such as toys and mobile phones, the country’s exports to the United States climbed to a total value of $536.8 billion in 2017.

At the same time period, the total value of US exports to China rose to $153.8 billion. The figures point out how dependent the United States and China still are on each other even after years of trade conflict between them. While some of the increase in trade between the two countries can be attributed to the rising cost of living, the figures also point out how dependent the United States and China still are on each other.

Russia-Ukraine War

One year after Russian forces stormed over the Ukrainian border and reached the gates of the capital city of Kyiv in a full-scale invasion that Moscow thought would bring a fast triumph, one of the most astounding elements of the conflict thus far is that Ukraine has survived. When the first shock of the worst battle to occur in Europe since World War II begins to wear off, people have a tendency to take the defiance of the Ukrainians for granted.

USDCAD is moving in the Descending triangle pattern and the market has reached the lower high area of the pattern.

But, due to careful preparation, bravery, and strategy, as well as financial and military aid from other countries, and Russia’s poor performance on the battlefield, Ukraine has been able to keep the adversary at bay for far longer than many people anticipated they would be able to do so. Having said that, Russia has begun to make incremental gains ahead of what Kyiv fears will be another major offensive, and has stabilized its positions in the east and south of Ukraine after suffering major setbacks late in 2022.

This comes as Ukraine fears that Russia will launch another major offensive. Sanctions on Moscow have not yet had a severe impact on the economy, and the Russian military still has resources to hurl at the battle. Despite all of these factors, Russian President Vladimir Putin appears ready to dig in.

Feds Bowman Speech

Governor Michelle Bowman of the Federal Reserve recently gave a speech where she talked about the banking regulations and the recent FOMC meeting. She reveals, “The economic outlook and the outlook for inflation continue to be highly uncertain. Global and domestic factors are contributing to heightened uncertainty, and I expect that we will continue to be surprised by economic and geopolitical developments and by the incoming data. While we have seen modestly lower inflation readings in recent months, overall inflation remains high. Measures of core services inflation have been persistently elevated, and labor demand exceeds the supply of available workers, which is leading employers to increase wages in an effort to retain and attract workers.”

EURUSD is moving in the Descending channel and the market has rebounded from the lower low area of the channel

“The ongoing tightness in the labor market puts upward pressure on inflation, even if some components of inflation moderate due to improvements in supply-side factors. The longer high inflation persists, the more likely it is that households and businesses may come to expect higher inflation in the longer term. Should that be the case, the FOMC’s job of lowering inflation would be even more challenging.

Given the highly uncertain environment, my views on the future path of monetary policy will continue to be informed by the incoming data and its implications for the outlook. I will continue to look for consistent evidence that inflation remains on a downward path when considering further rate increases and at what point we will have achieved a sufficiently restrictive stance for the policy rate.”

Inflation Reduction Act (IRA)

The United States Inflation Reduction Act (IRA) is less about bringing inflation under control and more about providing tax cuts and subsidies to certain industries. The five-year initiative will establish incentives to increase economic development in the United States and offer the country’s manufacturing sector a competitive advantage as it transitions to cleaner technology.

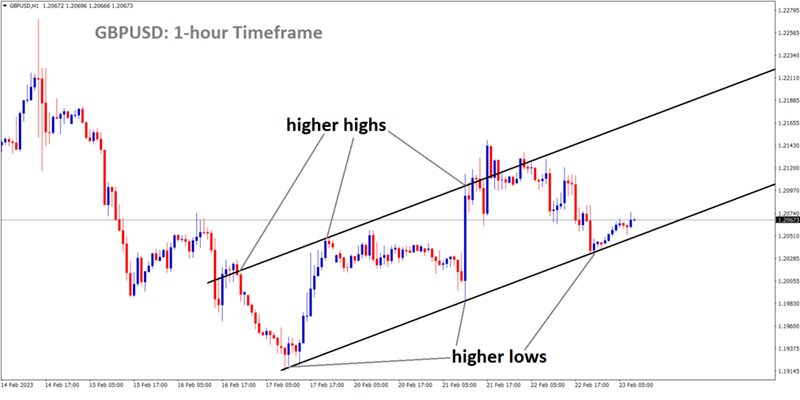

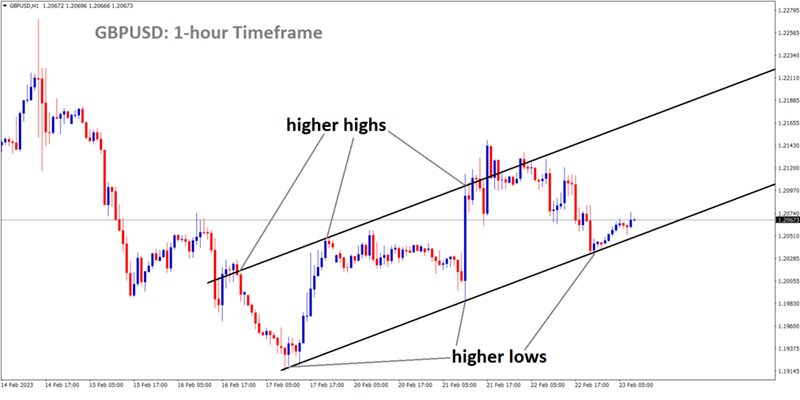

GBPUSD is moving in an Ascending channel and the market has reached the higher low area of the channel.

It is possible that it may speed up the transition to green energy, which will result in new winners and legacy losers throughout the world, which investors will need to keep an eye on. The Act incorporates into the government’s budget not just expenditure on environmentally friendly infrastructure but also cost cutting measures to guarantee that the entire effect would result in a surplus of funds after ten years.

The majority of the emphasis that has been paid to it centers on incentives to shift the economy of the United States towards the green transition, which will, in turn, serve to drive the larger global revolution in sustainability. The provision of support is contingent on businesses engaging in manufacturing and investment activities in the United States that enable them to obtain tax credits, as well as consumers purchasing electric cars built in the United States.

Geopolitical Tensions To Impact Upcoming US GDP Data

XAUUSD is moving in the Descending channel and the market has fallen from the lower high area of the channel.

In 2022, above-average inflation wiped at least 4 percentage points off of government debt in advanced countries and over 1 percentage point in EMDEs. This occurred at a time when inflation was soaring and GDP was coming to a standstill.

In contrast, the impact of growth that was above average in both advanced economies and EMDEs was essentially nonexistent. Hence, inflation will lower the debt-to-GDP ratio for advanced nations by about 6 percentage points of GDP during the period of two years beginning in 2020 and ending in 2022, while economic growth will have around half of the impact.

Above-average inflation and growth contributed to a reduction in debt-to-GDP ratios of more than 4 percentage points for EMDEs that did not include China, Russia, or Ukraine. Inflation was responsible for almost 3 percentage points of GDP decline, and growth was responsible for more than 1 percentage point of GDP decline.

The upcoming GDP data from the United States will further reveal how inflation and the geopolitical tensions around the world have impacted the nation.

US-China Trade War

In spite of the deterioration in diplomatic ties between the two countries in 2018, the volume of trade between the United States and China reached an all-time high. In 2022, the combined value of the two countries’ imports and exports was $690.6 billion. The latest incident with a Chinese balloon that flew across the United States has brought tensions between the two nations to new heights.

USDJPY has broken the Descending channel in Upside.

Beijing refutes allegations made by the United States that it was used for spying. A trade war has been going on between the world’s two largest economies, the United States and China, since 2018. As a result of increasing spending by American consumers on products manufactured in China, such as toys and mobile phones, the country’s exports to the United States climbed to a total value of $536.8 billion in 2017.

At the same time period, the total value of US exports to China rose to $153.8 billion. The figures point out how dependent the United States and China still are on each other even after years of trade conflict between them. While some of the increase in trade between the two countries can be attributed to the rising cost of living, the figures also point out how dependent the United States and China still are on each other.

Russia-Ukraine War

One year after Russian forces stormed over the Ukrainian border and reached the gates of the capital city of Kyiv in a full-scale invasion that Moscow thought would bring a fast triumph, one of the most astounding elements of the conflict thus far is that Ukraine has survived. When the first shock of the worst battle to occur in Europe since World War II begins to wear off, people have a tendency to take the defiance of the Ukrainians for granted.

USDCAD is moving in the Descending triangle pattern and the market has reached the lower high area of the pattern.

But, due to careful preparation, bravery, and strategy, as well as financial and military aid from other countries, and Russia’s poor performance on the battlefield, Ukraine has been able to keep the adversary at bay for far longer than many people anticipated they would be able to do so. Having said that, Russia has begun to make incremental gains ahead of what Kyiv fears will be another major offensive, and has stabilized its positions in the east and south of Ukraine after suffering major setbacks late in 2022.

This comes as Ukraine fears that Russia will launch another major offensive. Sanctions on Moscow have not yet had a severe impact on the economy, and the Russian military still has resources to hurl at the battle. Despite all of these factors, Russian President Vladimir Putin appears ready to dig in.

Feds Bowman Speech

Governor Michelle Bowman of the Federal Reserve recently gave a speech where she talked about the banking regulations and the recent FOMC meeting. She reveals, “The economic outlook and the outlook for inflation continue to be highly uncertain. Global and domestic factors are contributing to heightened uncertainty, and I expect that we will continue to be surprised by economic and geopolitical developments and by the incoming data. While we have seen modestly lower inflation readings in recent months, overall inflation remains high. Measures of core services inflation have been persistently elevated, and labor demand exceeds the supply of available workers, which is leading employers to increase wages in an effort to retain and attract workers.”

EURUSD is moving in the Descending channel and the market has rebounded from the lower low area of the channel

“The ongoing tightness in the labor market puts upward pressure on inflation, even if some components of inflation moderate due to improvements in supply-side factors. The longer high inflation persists, the more likely it is that households and businesses may come to expect higher inflation in the longer term. Should that be the case, the FOMC’s job of lowering inflation would be even more challenging.

Given the highly uncertain environment, my views on the future path of monetary policy will continue to be informed by the incoming data and its implications for the outlook. I will continue to look for consistent evidence that inflation remains on a downward path when considering further rate increases and at what point we will have achieved a sufficiently restrictive stance for the policy rate.”

Inflation Reduction Act (IRA)

The United States Inflation Reduction Act (IRA) is less about bringing inflation under control and more about providing tax cuts and subsidies to certain industries. The five-year initiative will establish incentives to increase economic development in the United States and offer the country’s manufacturing sector a competitive advantage as it transitions to cleaner technology.

GBPUSD is moving in an Ascending channel and the market has reached the higher low area of the channel.

It is possible that it may speed up the transition to green energy, which will result in new winners and legacy losers throughout the world, which investors will need to keep an eye on. The Act incorporates into the government’s budget not just expenditure on environmentally friendly infrastructure but also cost cutting measures to guarantee that the entire effect would result in a surplus of funds after ten years.

The majority of the emphasis that has been paid to it centers on incentives to shift the economy of the United States towards the green transition, which will, in turn, serve to drive the larger global revolution in sustainability. The provision of support is contingent on businesses engaging in manufacturing and investment activities in the United States that enable them to obtain tax credits, as well as consumers purchasing electric cars built in the United States.