Upcoming FOMC Meeting Minutes Will Reveal Rate Hike Plans

On Wednesday, the minutes from the most recent meeting of the Federal Open Market Committee (FOMC) will be made public. These minutes will provide a glimpse into the discussion that led Fed policymakers to settle on an increase of 0.25% to the federal funds rate earlier this month. After a prior hike of 0.5%, which was preceded by four consecutive hikes of 0.75%, the 12 members of the FOMC decided, during their most recent meeting, to dial down the rate of hikes for the second time in a row, to 0.25%.

This comes after a previous hike of 0.5%, which was preceded by four consecutive hikes of 0.75%. The rate as of right now is somewhere in the range of 4.5 to 4.75%. The Federal Reserve is attempting to slow the development of the economy in order to keep inflation under control while at the same time avoiding causing a recession.

XAUUSD is moving in the Descending channel and the market has fallen from the lower high area of the channel

In the most recent minutes release, which was published in January and included details from December’s meeting, Fed officials expressed concern that the financial markets might interpret this as a sign that the agency’s commitment to bringing down inflation is flagging because they agreed that a less hawkish stance on hikes was needed but expressed agreement that a less hawkish stance on hikes was needed.

Blinken-Wang Talks

The United States and China travelled to Germany over the weekend in an effort to mend a fresh split in their relationship that was caused by the outcry over a Chinese balloon. Yet, a discussion between their senior diplomats demonstrated how challenging it will be to reach a deal. In their first meeting since the high-altitude craft negotiated the United States and prompted n bitter round of finger pointing.

The Secretary of State Antony Blinken and China’s State Councilor Wang Yi exchanged hooks on a variety of topics, including the balloon, Taiwan, North Korea, and Russia. The senior American official also stated that China was mulling over whether or not to provide Russia with weaponry for its conflict in Ukraine, which is a move that would significantly raise tensions to an even higher level.

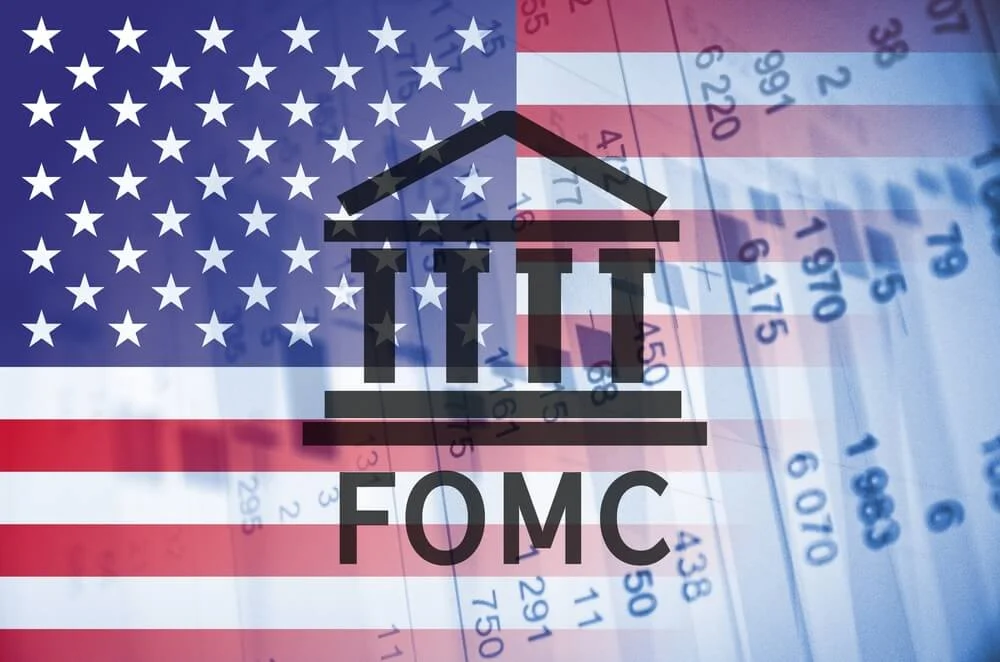

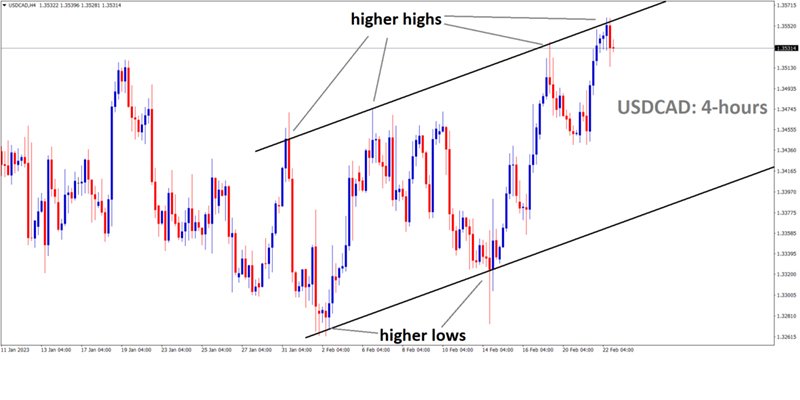

USDCAD is moving in an Ascending channel and the market has reached the higher high area of the channel.

Regarding the United States and China’s ties, I believe that investors will be focusing their attention on three major problems in the near future. First, the distancing of the two countries from one another. In spite of their competition and the rhetoric around trade, the United States and China continue to have a profound economic interdependence that has been steadily expanding over the course of several decades.

The second part of this discussion will focus on China’s reaction to the United States and other countries’ demand that Chinese individuals continue to abide by the COVID testing requirements now that the country has been reopened. Third is the separation from the West of the crucial technological sector, which is occurring as a result of Xi’s emphasis on technological self-reliance and state-led programs.

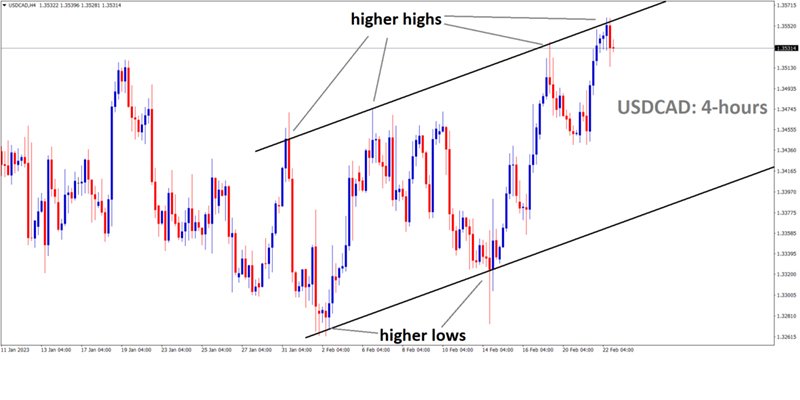

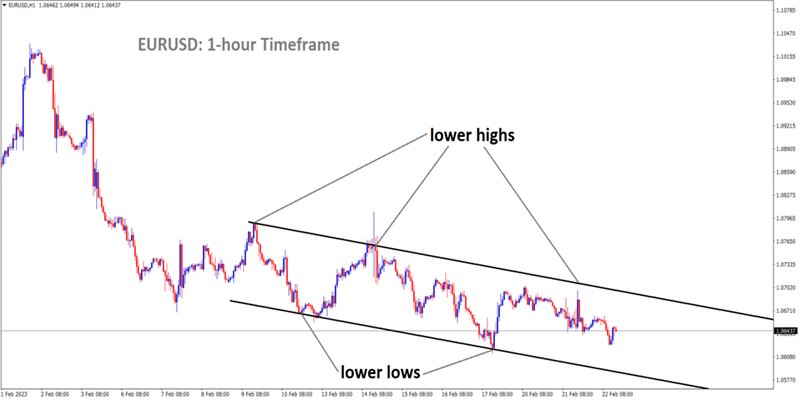

EURUSD is moving in the Descending channel and the market has fallen from the lower high area of the channel.

Investors will be closely monitoring US-China relations, particularly in light of recent talks between senior diplomats that failed to ease tensions, in order to determine which asset classes, sectors, and regions will benefit and to readjust their portfolios to capitalize on opportunities. This is especially important in light of the fact that recent talks between senior diplomats failed to ease tensions.

Feds Waller Speech

Feds Governor Christopher Waller recently gave a speech where he talked about the inflation rate and its impact on the basic necessities in the country. He reveals, “The big picture is that the U.S. economy is adjusting well so far to the higher interest rates that are necessary to rein in inflation. But inflation remains quite elevated, and so more needs to be done. Although economic activity slowed in 2022, I expect the Fed will need to keep a tight stance of monetary policy for some time to slow activity further in 2023.”

GBPUSD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

“That is what I believe is needed to bring demand and supply into better alignment and lower inflation toward the Federal Open Market Committee’s (FOMC) 2 percent target. Some believe that inflation will come down quite quickly this year. That would be a welcome outcome. But I’m not seeing signals of this quick decline in the economic data, and I am prepared for a longer fight to get inflation down to our target.”

“Looking forward, I expect personal consumption will grow modestly and price increases will moderate, and I think such outcomes would bode well for the agricultural sector this year. It looks as though economic activity may be moderating further in the first quarter of 2023, but I expect the U.S. economy to continue growing at a modest pace this year, supported by a strong labor market and by encouraging progress in lowering inflation. The Fed has stated that its target for inflation is headline PCE prices. So, to meet the Fed’s price stability objective, policymakers are accounting for all the categories of goods and services that affect households.”

Japan-North Korea Tensions

According to Seoul and Tokyo, North Korea fired an intercontinental ballistic missile on Saturday, which landed in Japan’s exclusive economic zone. This comes after Pyongyang threatened a harsh response to impending military maneuvers between the United States and South Korea.

USDJPY is moving in an Ascending channel and the market has reached the higher high area of the channel.

According to reports from Japan, North Korea launched one ICBM-class ballistic missile, which travelled for around 66 minutes before crashing into the exclusive economic zone of Japan. Yasukazu Hamada, the minister of defense in Tokyo, stated that the missile might have had the ability to go 14,000 kilometers, which indicates that it was capable of striking anyplace in the continental United States.

After a year in which North Korea declared itself an irreversible nuclear power and carried out weapons tests in violation of international sanctions, there has been an increase in the level of military tension on the Korean peninsula. In response, Seoul has increased the number of joint military drills that it conducts with its most important security ally, Washington, in an effort to reassure a public that is growing increasingly anxious about Pyongyang’s ability to threaten the United States with its nuclear arsenal.

Upcoming FOMC Meeting Minutes Will Reveal Rate Hike Plans

On Wednesday, the minutes from the most recent meeting of the Federal Open Market Committee (FOMC) will be made public. These minutes will provide a glimpse into the discussion that led Fed policymakers to settle on an increase of 0.25% to the federal funds rate earlier this month. After a prior hike of 0.5%, which was preceded by four consecutive hikes of 0.75%, the 12 members of the FOMC decided, during their most recent meeting, to dial down the rate of hikes for the second time in a row, to 0.25%.

This comes after a previous hike of 0.5%, which was preceded by four consecutive hikes of 0.75%. The rate as of right now is somewhere in the range of 4.5 to 4.75%. The Federal Reserve is attempting to slow the development of the economy in order to keep inflation under control while at the same time avoiding causing a recession.

XAUUSD is moving in the Descending channel and the market has fallen from the lower high area of the channel

In the most recent minutes release, which was published in January and included details from December’s meeting, Fed officials expressed concern that the financial markets might interpret this as a sign that the agency’s commitment to bringing down inflation is flagging because they agreed that a less hawkish stance on hikes was needed but expressed agreement that a less hawkish stance on hikes was needed.

Blinken-Wang Talks

The United States and China travelled to Germany over the weekend in an effort to mend a fresh split in their relationship that was caused by the outcry over a Chinese balloon. Yet, a discussion between their senior diplomats demonstrated how challenging it will be to reach a deal. In their first meeting since the high-altitude craft negotiated the United States and prompted n bitter round of finger pointing.

The Secretary of State Antony Blinken and China’s State Councilor Wang Yi exchanged hooks on a variety of topics, including the balloon, Taiwan, North Korea, and Russia. The senior American official also stated that China was mulling over whether or not to provide Russia with weaponry for its conflict in Ukraine, which is a move that would significantly raise tensions to an even higher level.

USDCAD is moving in an Ascending channel and the market has reached the higher high area of the channel.

Regarding the United States and China’s ties, I believe that investors will be focusing their attention on three major problems in the near future. First, the distancing of the two countries from one another. In spite of their competition and the rhetoric around trade, the United States and China continue to have a profound economic interdependence that has been steadily expanding over the course of several decades.

The second part of this discussion will focus on China’s reaction to the United States and other countries’ demand that Chinese individuals continue to abide by the COVID testing requirements now that the country has been reopened. Third is the separation from the West of the crucial technological sector, which is occurring as a result of Xi’s emphasis on technological self-reliance and state-led programs.

EURUSD is moving in the Descending channel and the market has fallen from the lower high area of the channel.

Investors will be closely monitoring US-China relations, particularly in light of recent talks between senior diplomats that failed to ease tensions, in order to determine which asset classes, sectors, and regions will benefit and to readjust their portfolios to capitalize on opportunities. This is especially important in light of the fact that recent talks between senior diplomats failed to ease tensions.

Feds Waller Speech

Feds Governor Christopher Waller recently gave a speech where he talked about the inflation rate and its impact on the basic necessities in the country. He reveals, “The big picture is that the U.S. economy is adjusting well so far to the higher interest rates that are necessary to rein in inflation. But inflation remains quite elevated, and so more needs to be done. Although economic activity slowed in 2022, I expect the Fed will need to keep a tight stance of monetary policy for some time to slow activity further in 2023.”

GBPUSD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

“That is what I believe is needed to bring demand and supply into better alignment and lower inflation toward the Federal Open Market Committee’s (FOMC) 2 percent target. Some believe that inflation will come down quite quickly this year. That would be a welcome outcome. But I’m not seeing signals of this quick decline in the economic data, and I am prepared for a longer fight to get inflation down to our target.”

“Looking forward, I expect personal consumption will grow modestly and price increases will moderate, and I think such outcomes would bode well for the agricultural sector this year. It looks as though economic activity may be moderating further in the first quarter of 2023, but I expect the U.S. economy to continue growing at a modest pace this year, supported by a strong labor market and by encouraging progress in lowering inflation. The Fed has stated that its target for inflation is headline PCE prices. So, to meet the Fed’s price stability objective, policymakers are accounting for all the categories of goods and services that affect households.”

Japan-North Korea Tensions

According to Seoul and Tokyo, North Korea fired an intercontinental ballistic missile on Saturday, which landed in Japan’s exclusive economic zone. This comes after Pyongyang threatened a harsh response to impending military maneuvers between the United States and South Korea.

USDJPY is moving in an Ascending channel and the market has reached the higher high area of the channel.

According to reports from Japan, North Korea launched one ICBM-class ballistic missile, which travelled for around 66 minutes before crashing into the exclusive economic zone of Japan. Yasukazu Hamada, the minister of defense in Tokyo, stated that the missile might have had the ability to go 14,000 kilometers, which indicates that it was capable of striking anyplace in the continental United States.

After a year in which North Korea declared itself an irreversible nuclear power and carried out weapons tests in violation of international sanctions, there has been an increase in the level of military tension on the Korean peninsula. In response, Seoul has increased the number of joint military drills that it conducts with its most important security ally, Washington, in an effort to reassure a public that is growing increasingly anxious about Pyongyang’s ability to threaten the United States with its nuclear arsenal.