Top 10 Forex News and Analysis – Feb 28, 2023

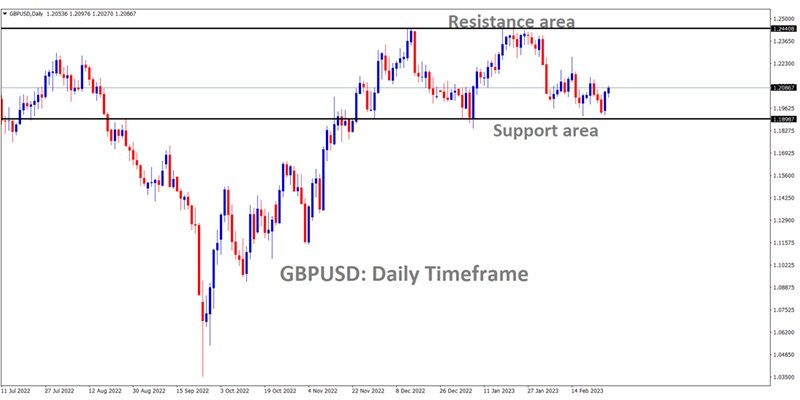

GBPUSD Analysis

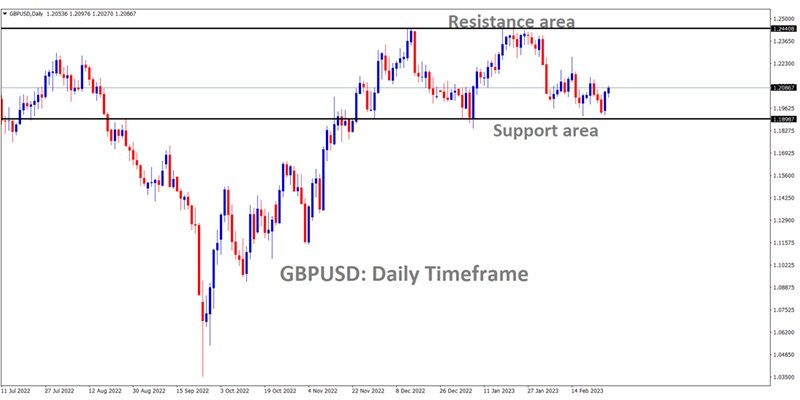

GBPUSD is moving in the Box Pattern and the market has rebounded from the Horizontal support area of the pattern.

On Monday, the British pound rose slightly on the hopes that the United Kingdom and the European Union would reach a protocol agreement regarding Northern Ireland. An easy transition into the United Kingdom and the European Union is ensured by the Winsor Framework’s plan for Northern Ireland.

After strong gains on Monday thanks to the outlining of a trade pact that can cope with the situation in Northern Ireland, the British pound has eased slightly today. It’s called the Windsor Framework, and it’s meant to make it simple for Northern Ireland to participate in the economies of both the European Union and Great Britain.

Yesterday, the US dollar fell in tandem with falling Treasury yields, and today’s exchange markets have been relatively calm. Federal Reserve Governor Philip Jefferson said last night that despite the difficulty of achieving the 2% inflation goal, it should be maintained. He stressed that any shift in the objective could pave the way for future improvisations.

Year-to-date shipments from Hong Kong were -36.7% y/y by the end of January, well below the 27.6% projection. A positive counterbalance to this discouraging data collection was the 945-day ban on face coverings being lifted. Broader measures of Chinese equities, including the Hang Seng Index (HIS), remained mostly positive.

The WTI futures contract is currently trading near US$ 76 bbl, while the Brent contract is following above US$ ‘82.50 bbl, both within their respective recent bands. The price of spot gold has been relatively stable today, hovering around US$ 1,815 per ounce as of this writing.

Statistics on gross domestic product (GDP) for France and Canada will be released today, and several central bank presenters from both sides of the Atlantic will be broadcasting their thoughts.

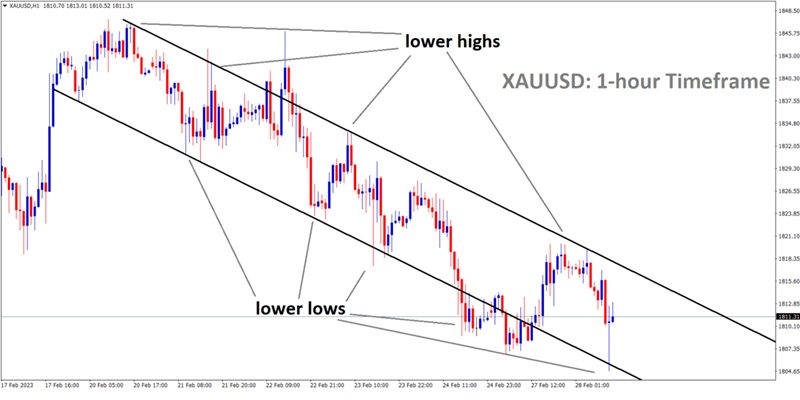

GOLD Analysis

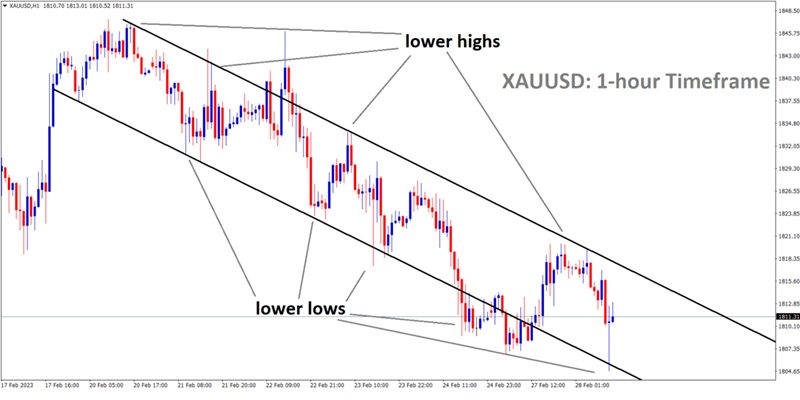

XAUUSD Gold price is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

The strong numbers produced by the US PCE Index suggest that any hopes of a reduction in inflation are unrealistic under the present circumstances. Once the FED confirmed rate hikes would be required at upcoming meetings, US Treasury yields rose. As a result of this theory, non-yielding assets, such as gold, will experience a decline in the future days.

The gold price is struggling to profit on the previous day’s modest rebound from the $1,807-$1,806 area, or the YTD low, and will face new supply on Tuesday. The XAU/USD has remained depressed throughout the early European session, trading just above the $1,810 mark, down nearly 0.30% on the day. Following a modest pullback from a seven-week high on Monday, the US Dollar (USD) is back in demand amid forecasts of further Federal Reserve policy tightening (Fed). This, in turn, is seen as a major factor putting downward pressure on the price of gold denominated in US dollars. Markets now appear to be persuaded that the Fed will maintain its hawkish attitude in the face of persistently high inflation.

The Personal Consumption Expenditure (PCE) Price Index from the United States (US) lifted the bets, indicating that inflation isn’t falling as quickly as anticipated. Furthermore, several Fed officials emphasised the importance of raising interest rates in order to reduce inflation. This continues to sustain elevated US Treasury bond yields while driving flow away from the non-yielding Gold price. Meanwhile, investors are concerned about economic headwinds caused by rapidly increasing borrowing costs. This, combined with geopolitical tensions, keeps the overnight bullish move in the equity markets in check and gives some support to the safe-haven Gold price. As a result, before making new bearish bets around the XAU/USD and positioning for further depreciation, traders should exercise caution. Nonetheless, the possibility of further Fed policy tightening should continue to boost the Greenback, favouring XAU/USD bears. The gold price appears set to fall further below $1,800 and challenge the 100-day Simple Moving Average (SMA) support, which is currently around $1,792. This should serve as a tipping point, and if it is decisively broken, it will set the scene for even greater losses.

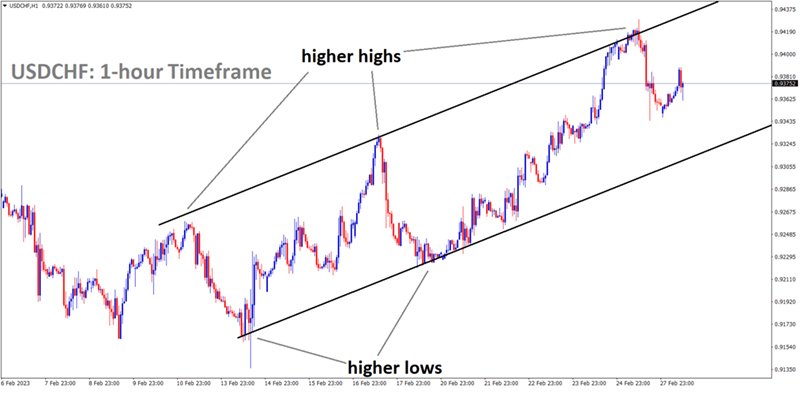

USDCHF Analysis

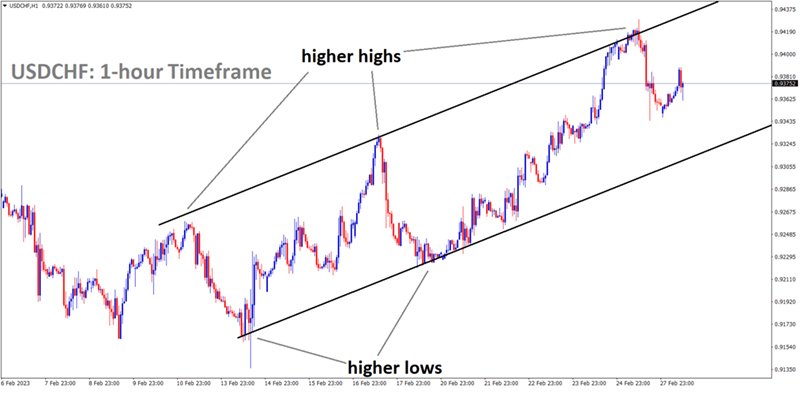

USDCHF is moving in an Ascending channel and the market has fallen from the higher high area of the channel.

Swiss GDP Q4 is scheduled for today, with QoQ data anticipated to be 0.30% versus 0.20% previously. However, YoY statistics indicate a 1.2% contraction versus 0.50% growth previously. The USDCHF is showing little correction advance of today’s data; the Swiss Franc prefers to be stronger if the data is positive.

USD/CHF portrays the pre-data anxiety while making rounds to 0.9350 during early Tuesday. Even so, the cautious optimism in the market, as well as the broad US Dollar weakness, allows the Swiss currency pair to consolidate the first monthly gain in four. The trade-positive headline from the White House joined a retreat in the US Treasury bond yields to underpin the latest cautious optimism. That said, the US offers an olive branch to China companies despite its political differences with the dragon nation, allowing the S&P 500 Futures to track Wall Street’s gains by the press time. Despite fraying relations with Beijing, US President Joe Biden is expected to forego expansive new restrictions on American investment in China, denying a push by some hawks in his administration and Congress, reported Politico late Monday.

It’s worth noting that the US Treasury bond yields remain lackluster while the S&P 500 Futures print mild gains by tracking Wall Street’s upbeat closing amid quiet hours of Tuesday’s trading. On Monday, US Durable Goods Orders slumped -4.5% in January versus -4.0% expected and 5.1% prior. However, the Nondefense Capital Goods Orders ex Aircraft grew 0.8% versus 0.0% analysts’ expectations and -0.3% previous readings. On the same line, the US Pending Home Sales rallied 8.0% MoM versus 1.0% expected and 1.1% prior.

Even so, Federal Reserve Governor Philip Jefferson said on Monday that it is important to get back to 2% inflation to allow those sorts of sustained economic gains. Reuters also portrayed hawkish Fed concerns while saying, “Economic data this month reflected still tight jobs markets and inflation remaining sticky, leading Fed funds futures traders to bet on higher rates, which in the US are now seen peaking in September at 5.4%, up from 4.58% now.

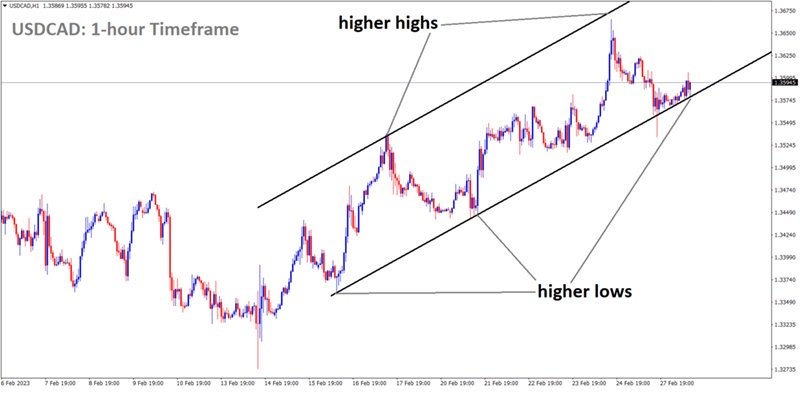

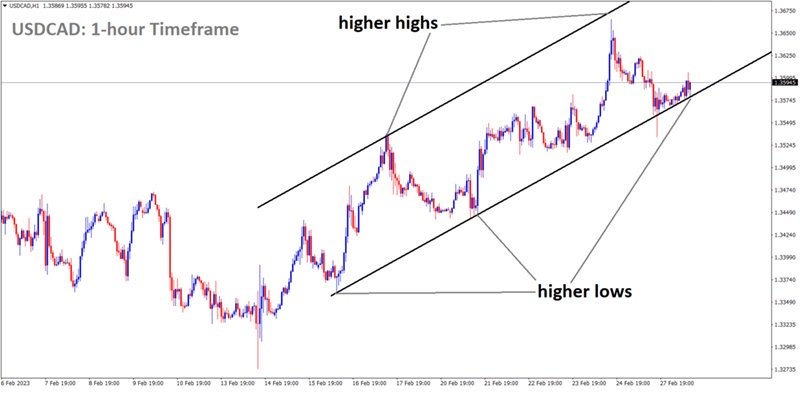

USDCAD Analysis

USDCAD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

US Vice President Joe Biden intends to reduce new investments in China, which could include the semiconductor sector or artificial intelligence projects. Still, a debate must take place in the Senate to determine what kind of activities should be scaled back in China.

Despite deteriorating ties with Beijing, US President Joe Biden is expected to reject extensive new limits on American investment in China, rejecting a drive by some hawks in his administration and Congress,” Politico reported on Monday. According to the news, US President Biden is scaling back a planned executive order to supervise American investments in China to concentrate primarily on increasing transparency of those deals, citing five anonymous individuals on Capitol Hill and K Street with knowledge of the White House talks.

The directive may still forbid US investments in at least one Chinese industry – advanced semiconductors – but it is unlikely to prevent funds from flowing to other sectors of China’s high-tech economy. The order is now anticipated to largely require US companies to notify federal authorities when engaging in transactions in industries such as quantum computing and artificial intelligence, though some other investment prohibitions are being debated.

Though the final order is still in the works, the administration is likely to establish a pilot programmed requiring US firms entering into new agreements with Chinese artificial intelligence and quantum computing firms to reveal details to government authorities. The Senate Banking Committee will conduct a hearing on sanctions, export controls, and “other tools” such as outbound investment screening on Tuesday.

EURUSD Analysis

EURUSD is moving in the Descending channel and the market has reached the lower high area of the channel.

Inflation statistics for the Eurozone will be released this week, with core inflation serving as a primary determinant of an ECB rate hike. The Euro’s strength against its counterparts is being fueled by market anticipation of a rate increase from the European Central Bank.

This article focuses on the latest European inflation numbers. According to Commerzbank’s analysts, the Euro could gain if the core inflation rate surprises to the upside.For the time being, EUR/USD values should be kept low.Core inflation is expected to have stayed steadfast in February despite the headline rate falling. The ECB has stressed on numerous occasions that it is paying close attention to the evolution of core inflation because the fundamental price increases are important to the ECB.

After yesterday’s appreciation against the US dollar, the Euro may obtain additional appreciation momentum if a positive surprise occurs.

GBPJPY Analysis

GBPJPY is moving in the Descending channel and the market has reached the lower high area of the channel.

Incoming Deputy Governor Himino of the Bank of Japan stated that ultra-easy monetary policy is beneficial for the economy but bad for institutional profits. When inflation reaches our objective, the Bank of Japan will withdraw from the stimulus.

Once geopolitical tensions have subsided and import prices have begun to fall, the Bank of Japan will determine to tighten monetary policy.

On Tuesday, incoming Bank of Japan (BoJ) Deputy Governor Ryozo Himino will appear before Japan’s Upper House. The strategy of negative interest rates has a negative effect on the profits of financial institutions. Although the negative effect of negative interest rates on banks must be considered, the emphasis should now be on maintaining easy policy to support the economy. It is necessary to consider various situations for stimulus exit and devise responses to them.

If the conditions are met for the Bank of Japan to abandon its easy policy, it will benefit both the people and banks. It is critical to consider various situations in order to steer a smooth exit from easy policy. The best strategy is to support the economy with easy policy until inflation reaches the BoJ’s price target, excluding the impact of rising import prices. Only when stable, sustained achievement of Boj’s price goal is in sight should specifics of exit strategy be debated.

When the inflation goal is reached in a stable and sustainable manner, a specific debate on exiting stimulus should be held. The BoJ may need to plan for different scenarios, but actual exit details should be determined based on economic conditions at the moment. Import prices must be closely monitored to see how they influence trend inflation. Currency rates should change steadily in response to economic fundamentals.

AUDUSD Analysis

AUDUSD is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

The Australian dollar exhibits no reaction to positive news. Monthly retail sales figures for January are 1.9% higher than expected at 1.5%. Retail revenue fell 3.9% in December, which is significant. Ahead of the US ISM manufacturing PMI report, the Australian Dollar is losing ground in the markets.

In the Asian session, the AUD/USD pair is battling to break through the 0.6750 resistance level. The Aussie asset’s recovery move from round-level support of 0.6700 lacks vigour because the risk-off attitude has not yet subsided. After establishing a cushion around 104.30, the US Dollar Index (DXY) has tried a recovery. However, a sideways performance is generally expected following a vertical decline and ahead of the release of the US ISM Manufacturing PMI data. After a small recovery on Monday, S&P500 futures have added more gains. US 10-year Treasury yields are battling to stay above 3.92%.

Despite the release of upbeat monthly Retail Sales (Jan) data, the Australian Dollar has failed to find substantial bids. The Australian Bureau of Statistics published monthly economic data at 1.9%, which was higher than the 1.5% consensus. Store sales fell by 3.9% in December. The AUD/USD pair has created a Hammer candlestick pattern near the critical support line drawn from the December 29 low of 0.6710. The formation of a Hammer candlestick suggests the emergence of responsive buyers who see the commodity as a “value buy” now after a massive drop.

It is worth observing that the asset has deviated significantly from its five-period Exponential Moving Average (EMA) of 0.6768. Extremely short-term EMAs are typically adhesive with one another. Price return to the EMA occurs when there is divergence. As a result, a downward movement cannot be ruled out. The Relative Strength Index (RSI) (14) has fallen into the bearish region of 20.00-40.00, favouring a downward trend.

If the Australian asset falls below Monday’s low of around 0.6700, US Dollar investors will drag it towards the December 7 low of 0.6668, followed by the December 20 low of 0.6629. A breach above the February 23 high of 0.6842, on the other hand, will propel the asset towards the February 21 high of 0.6920. A breach above the latter will expose the major for further gains towards the psychological resistance level of 0.7000.

NZDUSD Analysis

NZDUSD is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

New Zealand is facing inflationary challenges. Retail demand falls as the dollar falls in the markets. Retail sales for CY-2022 are down 0.6% compared to forecasts of 1.5%. This is good news for the RBNZ’s rate hike plans and the Chinese Caixin manufacturing PMI statistics due this week.

After a long period of lockdown, the economy is now opening up with a hefty stimulus to restore manufacturing to a high level, as anticipated by investors. This data is the primary cause of New Zealand Dollar movements this week.

In the Asian session, the NZD/USD pair produced a downside break of the sideways auction formed in a band of 0.6160-0.6182. The Kiwi asset has now fallen further, approaching 0.6130 in the early European session, as the risk-on profile has receded following a recovery move. The US Dollar Index (DXY) has prolonged its recovery move to near 104.50, as brisk consumer spending in the US economy strengthens the case for the Federal Reserve to maintain policy tightening (Fed).

S&P500 futures have relinquished their entire Asian session gains, indicating a complete recovery in the risk aversion theme. In addition, 10-year US Treasury rates have risen above 3.93%. Bearish bets on the New Zealand Dollar are increasing as investors become nervous ahead of the publication of the Caixin Manufacturing PMI (Feb) data on Wednesday. Investors anticipate a rise in PMI figures to 50.2 from the previous release of 49.2. The Chinese economy’s reopening with a promising economic outlook as a result of fiscal stimulus has backed up bullish wagers on the Caixin PMI data. It is worth mentioning that New Zealand is one of China’s most important trading partners, and increased manufacturing activity will strengthen the New Zealand Dollar. Inflationary forces in the New Zealand economy may ease further as retail demand has fallen sharply. The Retail Sales figures for the fourth quarter of CY2022 decreased by 0.6%, while the market expected a 1.5% increase. The Reserve Bank of New Zealand may benefit from this (RBNZ).

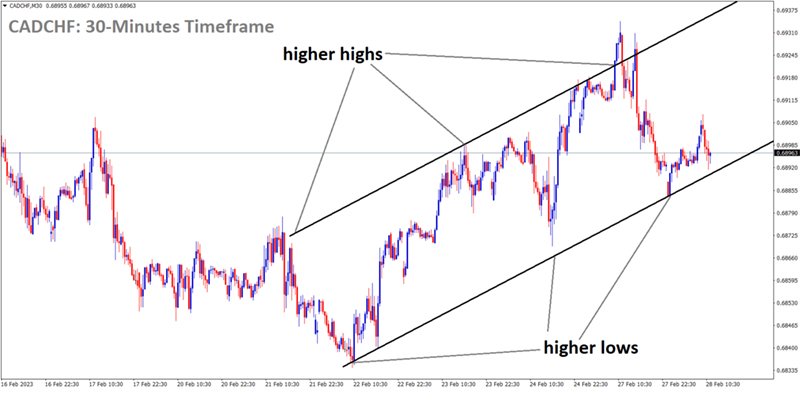

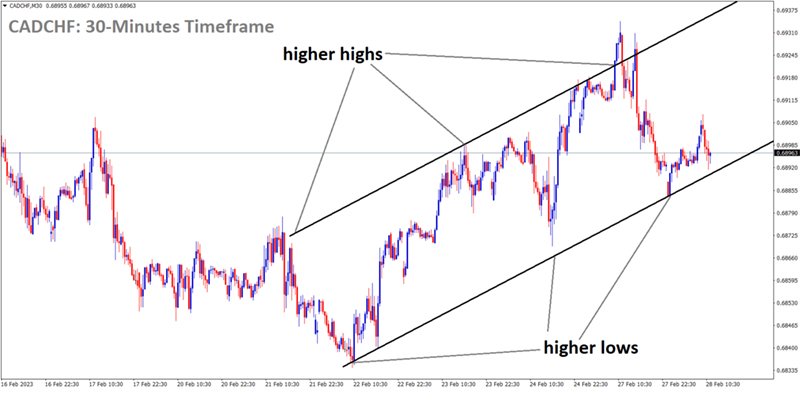

CADCHF Analysis

CADCHF is moving in an Ascending channel and the market has reached the higher low area of the channel.

Canadian GDP is expected to be lower later today, with the QoQ number expected to be negative. As the first quarter of contractionary growth since Q2 2021, this could exacerbate recessionary worries in Canada.

Moving on, the fourth quarter (Q4) Gross Domestic Product of Switzerland will be critical for imminent direction. Forecasts indicate that QoQ GDP will be up 0.3% versus 0.2% previously, but the YoY number indicates that economic activity will be down 1.2% versus 0.5% previously. Aside from Swiss GDP, second-tier US data, such as the Conference Board’s Consumer Confidence, Chicago Purchasing Managers’ Index, and Richmond Fed Manufacturing Index for February, as well as preliminary US trade numbers for January, will be important for USD/CHF traders to monitor for clear direction.

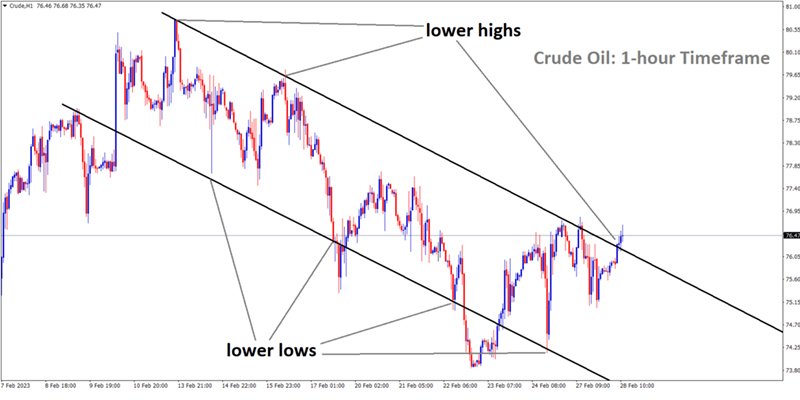

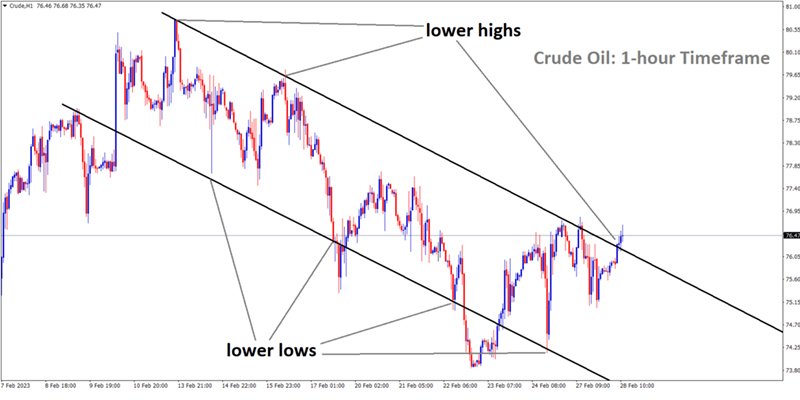

Crude Oil Analysis

Crude Oil price is moving in the Descending channel and the market has reached the lower high area of the channel.

Oil prices are consolidating and falling due to Chinese covid-19 lockdown problems. Now, hopes are that China will increase manufacturing activities and the economy’s speed by reducing lockdown activities.

The annualised growth estimate for Canadian GDP has shrunk to 1.5% from 2.9% previously.

As traders prepare for fourth-quarter (Q4) Canadian GDP data, the Loonie pair fails to validate the recent rebound in Canada’s major export item, namely WTI crude oil. Nonetheless, WTI crude oil bulls are eyeing a $76.00 intraday high, reversing the previous day’s decline from a one-week high. It is worth noting that expectations for lower US-China tensions, higher inflation, and increased Chinese manufacturing activity all add to the black gold’s recent rebound.

The US Dollar Index, on the other hand, is marginally higher around 104.80 after a weak start to the week, as greenback bulls cheer hawkish Fed bets despite mixed US data and a lacklustre day so far. Concerning risk catalysts, market sentiment improves as a result of news suggesting that the United States, despite its political differences with China, offers an olive branch to Chinese companies. Despite strained ties with Beijing, US President Joe Biden is expected to reject new restrictions on American investment in China, despite pressure from some hawks in his cabinet and Lawmakers, Politico reported late Monday.

Top 10 Forex News and Analysis – Feb 28, 2023

GBPUSD Analysis

GBPUSD is moving in the Box Pattern and the market has rebounded from the Horizontal support area of the pattern.

On Monday, the British pound rose slightly on the hopes that the United Kingdom and the European Union would reach a protocol agreement regarding Northern Ireland. An easy transition into the United Kingdom and the European Union is ensured by the Winsor Framework’s plan for Northern Ireland.

After strong gains on Monday thanks to the outlining of a trade pact that can cope with the situation in Northern Ireland, the British pound has eased slightly today. It’s called the Windsor Framework, and it’s meant to make it simple for Northern Ireland to participate in the economies of both the European Union and Great Britain.

Yesterday, the US dollar fell in tandem with falling Treasury yields, and today’s exchange markets have been relatively calm. Federal Reserve Governor Philip Jefferson said last night that despite the difficulty of achieving the 2% inflation goal, it should be maintained. He stressed that any shift in the objective could pave the way for future improvisations.

Year-to-date shipments from Hong Kong were -36.7% y/y by the end of January, well below the 27.6% projection. A positive counterbalance to this discouraging data collection was the 945-day ban on face coverings being lifted. Broader measures of Chinese equities, including the Hang Seng Index (HIS), remained mostly positive.

The WTI futures contract is currently trading near US$ 76 bbl, while the Brent contract is following above US$ ‘82.50 bbl, both within their respective recent bands. The price of spot gold has been relatively stable today, hovering around US$ 1,815 per ounce as of this writing.

Statistics on gross domestic product (GDP) for France and Canada will be released today, and several central bank presenters from both sides of the Atlantic will be broadcasting their thoughts.

GOLD Analysis

XAUUSD Gold price is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

The strong numbers produced by the US PCE Index suggest that any hopes of a reduction in inflation are unrealistic under the present circumstances. Once the FED confirmed rate hikes would be required at upcoming meetings, US Treasury yields rose. As a result of this theory, non-yielding assets, such as gold, will experience a decline in the future days.

The gold price is struggling to profit on the previous day’s modest rebound from the $1,807-$1,806 area, or the YTD low, and will face new supply on Tuesday. The XAU/USD has remained depressed throughout the early European session, trading just above the $1,810 mark, down nearly 0.30% on the day. Following a modest pullback from a seven-week high on Monday, the US Dollar (USD) is back in demand amid forecasts of further Federal Reserve policy tightening (Fed). This, in turn, is seen as a major factor putting downward pressure on the price of gold denominated in US dollars. Markets now appear to be persuaded that the Fed will maintain its hawkish attitude in the face of persistently high inflation.

The Personal Consumption Expenditure (PCE) Price Index from the United States (US) lifted the bets, indicating that inflation isn’t falling as quickly as anticipated. Furthermore, several Fed officials emphasised the importance of raising interest rates in order to reduce inflation. This continues to sustain elevated US Treasury bond yields while driving flow away from the non-yielding Gold price. Meanwhile, investors are concerned about economic headwinds caused by rapidly increasing borrowing costs. This, combined with geopolitical tensions, keeps the overnight bullish move in the equity markets in check and gives some support to the safe-haven Gold price. As a result, before making new bearish bets around the XAU/USD and positioning for further depreciation, traders should exercise caution. Nonetheless, the possibility of further Fed policy tightening should continue to boost the Greenback, favouring XAU/USD bears. The gold price appears set to fall further below $1,800 and challenge the 100-day Simple Moving Average (SMA) support, which is currently around $1,792. This should serve as a tipping point, and if it is decisively broken, it will set the scene for even greater losses.

USDCHF Analysis

USDCHF is moving in an Ascending channel and the market has fallen from the higher high area of the channel.

Swiss GDP Q4 is scheduled for today, with QoQ data anticipated to be 0.30% versus 0.20% previously. However, YoY statistics indicate a 1.2% contraction versus 0.50% growth previously. The USDCHF is showing little correction advance of today’s data; the Swiss Franc prefers to be stronger if the data is positive.

USD/CHF portrays the pre-data anxiety while making rounds to 0.9350 during early Tuesday. Even so, the cautious optimism in the market, as well as the broad US Dollar weakness, allows the Swiss currency pair to consolidate the first monthly gain in four. The trade-positive headline from the White House joined a retreat in the US Treasury bond yields to underpin the latest cautious optimism. That said, the US offers an olive branch to China companies despite its political differences with the dragon nation, allowing the S&P 500 Futures to track Wall Street’s gains by the press time. Despite fraying relations with Beijing, US President Joe Biden is expected to forego expansive new restrictions on American investment in China, denying a push by some hawks in his administration and Congress, reported Politico late Monday.

It’s worth noting that the US Treasury bond yields remain lackluster while the S&P 500 Futures print mild gains by tracking Wall Street’s upbeat closing amid quiet hours of Tuesday’s trading. On Monday, US Durable Goods Orders slumped -4.5% in January versus -4.0% expected and 5.1% prior. However, the Nondefense Capital Goods Orders ex Aircraft grew 0.8% versus 0.0% analysts’ expectations and -0.3% previous readings. On the same line, the US Pending Home Sales rallied 8.0% MoM versus 1.0% expected and 1.1% prior.

Even so, Federal Reserve Governor Philip Jefferson said on Monday that it is important to get back to 2% inflation to allow those sorts of sustained economic gains. Reuters also portrayed hawkish Fed concerns while saying, “Economic data this month reflected still tight jobs markets and inflation remaining sticky, leading Fed funds futures traders to bet on higher rates, which in the US are now seen peaking in September at 5.4%, up from 4.58% now.

USDCAD Analysis

USDCAD is moving in an Ascending channel and the market has rebounded from the higher low area of the channel.

US Vice President Joe Biden intends to reduce new investments in China, which could include the semiconductor sector or artificial intelligence projects. Still, a debate must take place in the Senate to determine what kind of activities should be scaled back in China.

Despite deteriorating ties with Beijing, US President Joe Biden is expected to reject extensive new limits on American investment in China, rejecting a drive by some hawks in his administration and Congress,” Politico reported on Monday. According to the news, US President Biden is scaling back a planned executive order to supervise American investments in China to concentrate primarily on increasing transparency of those deals, citing five anonymous individuals on Capitol Hill and K Street with knowledge of the White House talks.

The directive may still forbid US investments in at least one Chinese industry – advanced semiconductors – but it is unlikely to prevent funds from flowing to other sectors of China’s high-tech economy. The order is now anticipated to largely require US companies to notify federal authorities when engaging in transactions in industries such as quantum computing and artificial intelligence, though some other investment prohibitions are being debated.

Though the final order is still in the works, the administration is likely to establish a pilot programmed requiring US firms entering into new agreements with Chinese artificial intelligence and quantum computing firms to reveal details to government authorities. The Senate Banking Committee will conduct a hearing on sanctions, export controls, and “other tools” such as outbound investment screening on Tuesday.

EURUSD Analysis

EURUSD is moving in the Descending channel and the market has reached the lower high area of the channel.

Inflation statistics for the Eurozone will be released this week, with core inflation serving as a primary determinant of an ECB rate hike. The Euro’s strength against its counterparts is being fueled by market anticipation of a rate increase from the European Central Bank.

This article focuses on the latest European inflation numbers. According to Commerzbank’s analysts, the Euro could gain if the core inflation rate surprises to the upside.For the time being, EUR/USD values should be kept low.Core inflation is expected to have stayed steadfast in February despite the headline rate falling. The ECB has stressed on numerous occasions that it is paying close attention to the evolution of core inflation because the fundamental price increases are important to the ECB.

After yesterday’s appreciation against the US dollar, the Euro may obtain additional appreciation momentum if a positive surprise occurs.

GBPJPY Analysis

GBPJPY is moving in the Descending channel and the market has reached the lower high area of the channel.

Incoming Deputy Governor Himino of the Bank of Japan stated that ultra-easy monetary policy is beneficial for the economy but bad for institutional profits. When inflation reaches our objective, the Bank of Japan will withdraw from the stimulus.

Once geopolitical tensions have subsided and import prices have begun to fall, the Bank of Japan will determine to tighten monetary policy.

On Tuesday, incoming Bank of Japan (BoJ) Deputy Governor Ryozo Himino will appear before Japan’s Upper House. The strategy of negative interest rates has a negative effect on the profits of financial institutions. Although the negative effect of negative interest rates on banks must be considered, the emphasis should now be on maintaining easy policy to support the economy. It is necessary to consider various situations for stimulus exit and devise responses to them.

If the conditions are met for the Bank of Japan to abandon its easy policy, it will benefit both the people and banks. It is critical to consider various situations in order to steer a smooth exit from easy policy. The best strategy is to support the economy with easy policy until inflation reaches the BoJ’s price target, excluding the impact of rising import prices. Only when stable, sustained achievement of Boj’s price goal is in sight should specifics of exit strategy be debated.

When the inflation goal is reached in a stable and sustainable manner, a specific debate on exiting stimulus should be held. The BoJ may need to plan for different scenarios, but actual exit details should be determined based on economic conditions at the moment. Import prices must be closely monitored to see how they influence trend inflation. Currency rates should change steadily in response to economic fundamentals.

AUDUSD Analysis

AUDUSD is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

The Australian dollar exhibits no reaction to positive news. Monthly retail sales figures for January are 1.9% higher than expected at 1.5%. Retail revenue fell 3.9% in December, which is significant. Ahead of the US ISM manufacturing PMI report, the Australian Dollar is losing ground in the markets.

In the Asian session, the AUD/USD pair is battling to break through the 0.6750 resistance level. The Aussie asset’s recovery move from round-level support of 0.6700 lacks vigour because the risk-off attitude has not yet subsided. After establishing a cushion around 104.30, the US Dollar Index (DXY) has tried a recovery. However, a sideways performance is generally expected following a vertical decline and ahead of the release of the US ISM Manufacturing PMI data. After a small recovery on Monday, S&P500 futures have added more gains. US 10-year Treasury yields are battling to stay above 3.92%.

Despite the release of upbeat monthly Retail Sales (Jan) data, the Australian Dollar has failed to find substantial bids. The Australian Bureau of Statistics published monthly economic data at 1.9%, which was higher than the 1.5% consensus. Store sales fell by 3.9% in December. The AUD/USD pair has created a Hammer candlestick pattern near the critical support line drawn from the December 29 low of 0.6710. The formation of a Hammer candlestick suggests the emergence of responsive buyers who see the commodity as a “value buy” now after a massive drop.

It is worth observing that the asset has deviated significantly from its five-period Exponential Moving Average (EMA) of 0.6768. Extremely short-term EMAs are typically adhesive with one another. Price return to the EMA occurs when there is divergence. As a result, a downward movement cannot be ruled out. The Relative Strength Index (RSI) (14) has fallen into the bearish region of 20.00-40.00, favouring a downward trend.

If the Australian asset falls below Monday’s low of around 0.6700, US Dollar investors will drag it towards the December 7 low of 0.6668, followed by the December 20 low of 0.6629. A breach above the February 23 high of 0.6842, on the other hand, will propel the asset towards the February 21 high of 0.6920. A breach above the latter will expose the major for further gains towards the psychological resistance level of 0.7000.

NZDUSD Analysis

NZDUSD is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

New Zealand is facing inflationary challenges. Retail demand falls as the dollar falls in the markets. Retail sales for CY-2022 are down 0.6% compared to forecasts of 1.5%. This is good news for the RBNZ’s rate hike plans and the Chinese Caixin manufacturing PMI statistics due this week.

After a long period of lockdown, the economy is now opening up with a hefty stimulus to restore manufacturing to a high level, as anticipated by investors. This data is the primary cause of New Zealand Dollar movements this week.

In the Asian session, the NZD/USD pair produced a downside break of the sideways auction formed in a band of 0.6160-0.6182. The Kiwi asset has now fallen further, approaching 0.6130 in the early European session, as the risk-on profile has receded following a recovery move. The US Dollar Index (DXY) has prolonged its recovery move to near 104.50, as brisk consumer spending in the US economy strengthens the case for the Federal Reserve to maintain policy tightening (Fed).

S&P500 futures have relinquished their entire Asian session gains, indicating a complete recovery in the risk aversion theme. In addition, 10-year US Treasury rates have risen above 3.93%. Bearish bets on the New Zealand Dollar are increasing as investors become nervous ahead of the publication of the Caixin Manufacturing PMI (Feb) data on Wednesday. Investors anticipate a rise in PMI figures to 50.2 from the previous release of 49.2. The Chinese economy’s reopening with a promising economic outlook as a result of fiscal stimulus has backed up bullish wagers on the Caixin PMI data. It is worth mentioning that New Zealand is one of China’s most important trading partners, and increased manufacturing activity will strengthen the New Zealand Dollar. Inflationary forces in the New Zealand economy may ease further as retail demand has fallen sharply. The Retail Sales figures for the fourth quarter of CY2022 decreased by 0.6%, while the market expected a 1.5% increase. The Reserve Bank of New Zealand may benefit from this (RBNZ).

CADCHF Analysis

CADCHF is moving in an Ascending channel and the market has reached the higher low area of the channel.

Canadian GDP is expected to be lower later today, with the QoQ number expected to be negative. As the first quarter of contractionary growth since Q2 2021, this could exacerbate recessionary worries in Canada.

Moving on, the fourth quarter (Q4) Gross Domestic Product of Switzerland will be critical for imminent direction. Forecasts indicate that QoQ GDP will be up 0.3% versus 0.2% previously, but the YoY number indicates that economic activity will be down 1.2% versus 0.5% previously. Aside from Swiss GDP, second-tier US data, such as the Conference Board’s Consumer Confidence, Chicago Purchasing Managers’ Index, and Richmond Fed Manufacturing Index for February, as well as preliminary US trade numbers for January, will be important for USD/CHF traders to monitor for clear direction.

Crude Oil Analysis

Crude Oil price is moving in the Descending channel and the market has reached the lower high area of the channel.

Oil prices are consolidating and falling due to Chinese covid-19 lockdown problems. Now, hopes are that China will increase manufacturing activities and the economy’s speed by reducing lockdown activities.

The annualised growth estimate for Canadian GDP has shrunk to 1.5% from 2.9% previously.

As traders prepare for fourth-quarter (Q4) Canadian GDP data, the Loonie pair fails to validate the recent rebound in Canada’s major export item, namely WTI crude oil. Nonetheless, WTI crude oil bulls are eyeing a $76.00 intraday high, reversing the previous day’s decline from a one-week high. It is worth noting that expectations for lower US-China tensions, higher inflation, and increased Chinese manufacturing activity all add to the black gold’s recent rebound.

The US Dollar Index, on the other hand, is marginally higher around 104.80 after a weak start to the week, as greenback bulls cheer hawkish Fed bets despite mixed US data and a lacklustre day so far. Concerning risk catalysts, market sentiment improves as a result of news suggesting that the United States, despite its political differences with China, offers an olive branch to Chinese companies. Despite strained ties with Beijing, US President Joe Biden is expected to reject new restrictions on American investment in China, despite pressure from some hawks in his cabinet and Lawmakers, Politico reported late Monday.