AUD Markets Anticipate Positive Upcoming Australia GDP Data

GBPAUD is moving in an Ascending channel and the market has reached the higher high area of the channel.

On Wednesday, the figures for gross domestic product (GDP) are expected to be released, and they should indicate a large contribution from foreign commerce as a result of the boom in resource exports. Due to the rise in pricing, the value of the goods mined from the earth surpassed A$400 billion for the first time in 2022. In addition, government expenditure contributed an additional 0.1 percentage point to GDP growth, while inventory levels, house prices, and consumer spending on products were considered as detracting from GDP growth.

RBA Lowe says, “In terms of economic growth, our central forecast is for GDP growth to slow to around 1½ per cent this year and next. The bounce-back in spending following the pandemic has largely run its course. More broadly, the combination of higher interest rates, cost-of-living pressures and the decline in housing prices is expected to weigh on household spending. A contraction in residential construction is also expected following the pandemic-related boom. In contrast, the outlook for business investment remains reasonably positive, with many firms operating at a high level of capacity utilization.”

Retail Sales Rebound

Despite the fact that the underlying pulse was experiencing headwinds from high inflation and increasing interest rates, Australian retail sales improved in January following a surprising drop in December that was mostly attributable to shifting purchasing habits. But, the data for spending on bank cards also reveals that customers have been lavishing their expenditure on services, especially travel, rather than on the items that are covered in the retail report.

AUDUSD is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

The Reserve Bank of Australia (RBA) has already increased interest rates by 325 basis points, bringing them to a 10-year high of 3.35 percent, and the markets are currently betting for more rate increases approaching 4.35 percent.

The Federal Reserve anticipates that the economy will expand by 1.4% this year and by 1.6% in the next year. This deceleration in growth should hopefully put demand back in line with supply and assist in bringing inflation under control.

Australia Inflation Crisis

Jim Chalmers, the Treasurer of Australia, stated on Sunday that the country’s persistently high inflation has likely reached its pinnacle, but he acknowledged that it continues to be a significant economic burden. The rate of inflation is currently 7.8%, which is the highest it has been in 32 years, and it is only predicted to slow to the top of the goal range that the Reserve Bank of Australia (RBA) has set for inflation of 2-3% by the middle of 2025

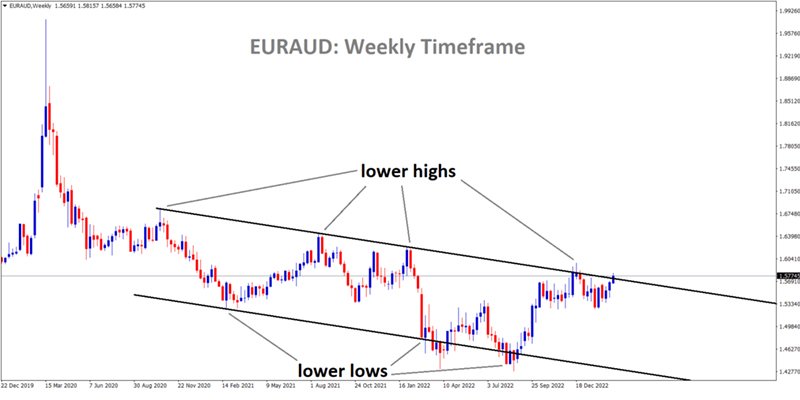

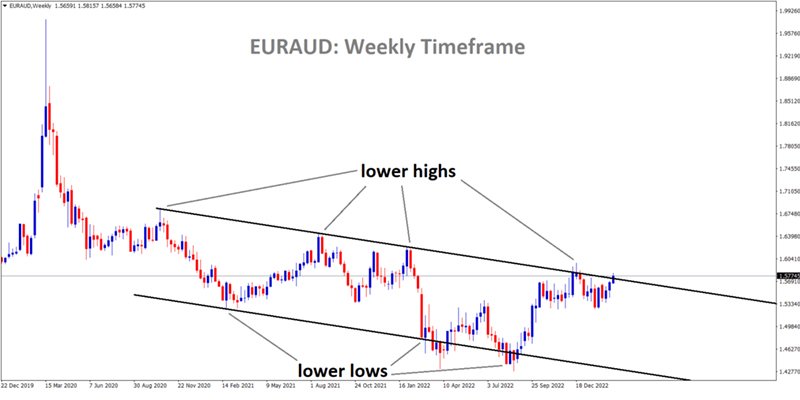

EURAUD is moving in the Descending channel and the market has reached the lower high area of the channel.

Chalmers made his remarks from India, where he was attending the G20 finance leaders’ event in Bengaluru. He stated that the world economy was on an extremely precarious road, with the threat of inflation on one side and a significant global recession on the other. The RBA has lately raised its projections for both core inflation and wage growth, and it has cautioned that more interest rate increases would be required to prevent a harmful wage-price spiral. In an effort to rein in spiraling prices, the Reserve Bank of Australia (RBA) raised its cash rate this month for the ninth time in a row, raising it to a new decade-high of 3.35 percent. This brings the total number of basis points added to the cash rate since May to 325.

UK Foreign Workers

There have been recent reports that officials from the state of Western Australia are planning to recruit as many as 31,000 workers from the United Kingdom and Ireland. Furthermore, a delegation from Down Under is scheduled to attend jobs fairs across the United Kingdom in order to promote the advantages of starting a new life and new careers on the other side of the world.

AUDJPY is moving in an ascending channel and the market has fallen from the higher high area of the channel.

The officials are particularly interested in headhunting important professionals such as educators, nurses, and police officers. For instance, nurses in Western Australia may regularly make more than £49,000 per year, which is 58% higher than the average salary in the United Kingdom, which is just over £30,000. When HRDs hear that Australian officials are keeping tabs on tens of thousands of workers, it is reasonable for them to be concerned about the situation.

The promise of higher wages, lower living costs, and a lifestyle that is known for being famously laid-back with sun and weekends spent at the beach could be more than enough to convince plenty of workers from the United Kingdom and Ireland to make the move abroad. Many businesses are already doing their utmost to retain their talent.

RBA Lowe Speech

Philip Lowe who is the governor of the Reserve Bank of Australia recently gave a speech where he discussed the high inflation and interest rates in the nation. He reveals, “High inflation is damaging and corrosive. It hurts people, puts pressure on household budgets and erodes the value of people’s savings. It increases inequality and hurts people on low incomes the most. High inflation also damages longer-term economic performance, making the environment uncertain for planning and investing. And if inflation does become ingrained in people’s expectations, bringing it back down again is very costly.”

AUDCAD is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

“History teaches us that once inflation becomes ingrained the end result is even higher interest rates and even greater unemployment to bring inflation back down. It would be dangerous, indeed, not to contain and reverse this period of high inflation. This episode of high inflation has its origins mainly in developments on the supply side but, over time, demand-side factors have become more prominent. It emerged in the wake of the COVID supply chain disruptions and Russia’s invasion of Ukraine, and also strong domestic demand due to the bounce-back from COVID and the large policy stimulus during the pandemic. As the central bank, we have a critical mandate to preserve medium-term price stability and we are committed to that objective. If we don’t get on top of inflation and bring it down in a timely way, the end result will be even higher interest rates and more unemployment in the future.”

AUD Markets Anticipate Positive Upcoming Australia GDP Data

GBPAUD is moving in an Ascending channel and the market has reached the higher high area of the channel.

On Wednesday, the figures for gross domestic product (GDP) are expected to be released, and they should indicate a large contribution from foreign commerce as a result of the boom in resource exports. Due to the rise in pricing, the value of the goods mined from the earth surpassed A$400 billion for the first time in 2022. In addition, government expenditure contributed an additional 0.1 percentage point to GDP growth, while inventory levels, house prices, and consumer spending on products were considered as detracting from GDP growth.

RBA Lowe says, “In terms of economic growth, our central forecast is for GDP growth to slow to around 1½ per cent this year and next. The bounce-back in spending following the pandemic has largely run its course. More broadly, the combination of higher interest rates, cost-of-living pressures and the decline in housing prices is expected to weigh on household spending. A contraction in residential construction is also expected following the pandemic-related boom. In contrast, the outlook for business investment remains reasonably positive, with many firms operating at a high level of capacity utilization.”

Retail Sales Rebound

Despite the fact that the underlying pulse was experiencing headwinds from high inflation and increasing interest rates, Australian retail sales improved in January following a surprising drop in December that was mostly attributable to shifting purchasing habits. But, the data for spending on bank cards also reveals that customers have been lavishing their expenditure on services, especially travel, rather than on the items that are covered in the retail report.

AUDUSD is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

The Reserve Bank of Australia (RBA) has already increased interest rates by 325 basis points, bringing them to a 10-year high of 3.35 percent, and the markets are currently betting for more rate increases approaching 4.35 percent.

The Federal Reserve anticipates that the economy will expand by 1.4% this year and by 1.6% in the next year. This deceleration in growth should hopefully put demand back in line with supply and assist in bringing inflation under control.

Australia Inflation Crisis

Jim Chalmers, the Treasurer of Australia, stated on Sunday that the country’s persistently high inflation has likely reached its pinnacle, but he acknowledged that it continues to be a significant economic burden. The rate of inflation is currently 7.8%, which is the highest it has been in 32 years, and it is only predicted to slow to the top of the goal range that the Reserve Bank of Australia (RBA) has set for inflation of 2-3% by the middle of 2025

EURAUD is moving in the Descending channel and the market has reached the lower high area of the channel.

Chalmers made his remarks from India, where he was attending the G20 finance leaders’ event in Bengaluru. He stated that the world economy was on an extremely precarious road, with the threat of inflation on one side and a significant global recession on the other. The RBA has lately raised its projections for both core inflation and wage growth, and it has cautioned that more interest rate increases would be required to prevent a harmful wage-price spiral. In an effort to rein in spiraling prices, the Reserve Bank of Australia (RBA) raised its cash rate this month for the ninth time in a row, raising it to a new decade-high of 3.35 percent. This brings the total number of basis points added to the cash rate since May to 325.

UK Foreign Workers

There have been recent reports that officials from the state of Western Australia are planning to recruit as many as 31,000 workers from the United Kingdom and Ireland. Furthermore, a delegation from Down Under is scheduled to attend jobs fairs across the United Kingdom in order to promote the advantages of starting a new life and new careers on the other side of the world.

AUDJPY is moving in an ascending channel and the market has fallen from the higher high area of the channel.

The officials are particularly interested in headhunting important professionals such as educators, nurses, and police officers. For instance, nurses in Western Australia may regularly make more than £49,000 per year, which is 58% higher than the average salary in the United Kingdom, which is just over £30,000. When HRDs hear that Australian officials are keeping tabs on tens of thousands of workers, it is reasonable for them to be concerned about the situation.

The promise of higher wages, lower living costs, and a lifestyle that is known for being famously laid-back with sun and weekends spent at the beach could be more than enough to convince plenty of workers from the United Kingdom and Ireland to make the move abroad. Many businesses are already doing their utmost to retain their talent.

RBA Lowe Speech

Philip Lowe who is the governor of the Reserve Bank of Australia recently gave a speech where he discussed the high inflation and interest rates in the nation. He reveals, “High inflation is damaging and corrosive. It hurts people, puts pressure on household budgets and erodes the value of people’s savings. It increases inequality and hurts people on low incomes the most. High inflation also damages longer-term economic performance, making the environment uncertain for planning and investing. And if inflation does become ingrained in people’s expectations, bringing it back down again is very costly.”

AUDCAD is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

“History teaches us that once inflation becomes ingrained the end result is even higher interest rates and even greater unemployment to bring inflation back down. It would be dangerous, indeed, not to contain and reverse this period of high inflation. This episode of high inflation has its origins mainly in developments on the supply side but, over time, demand-side factors have become more prominent. It emerged in the wake of the COVID supply chain disruptions and Russia’s invasion of Ukraine, and also strong domestic demand due to the bounce-back from COVID and the large policy stimulus during the pandemic. As the central bank, we have a critical mandate to preserve medium-term price stability and we are committed to that objective. If we don’t get on top of inflation and bring it down in a timely way, the end result will be even higher interest rates and more unemployment in the future.”