Top 10 Forex News and Analysis – Mar 09, 2023

USDJPY Analysis

USDJPY is moving in an ascending channel and the market has reached the higher low area of the channel.

Japanese GDP came in below expectations today for JPY buyers, printing at 0.10% as (QoQ) Q4 annualized versus 0.80% anticipated and the prior estimate of 0.60%.

The temporary news release caused the USDJPY to decline, and the Bank of Japan’s monetary policy continues to diverge from the goal of FED rate increases.

Following Federal Reserve Jerome Powell’s second day on Capitol Hill, the US dollar’s advance was halted, and USD/JPY is currently testing below 137.00 at the Tokyo start. Japanese GDP Annualised SA (QoQ) Q4 F: 0.1% (exp 0.8%; prev 0.6%), GDP SA (Q/Q) Q4 F: 0.0% (exp 0.2%; prev 0.2%), and GDP Nominal SA (QoQ) Q4 F: 1.2% (exp 1.3%; prev 1.3%), according to data recently published by the Cabinet Office. USD/JPY is down some 15 pips following the data while the US Dollar was otherwise steady in prior trade but down from three-month highs that were reached earlier on Wednesday after Federal Reserve Chairman Jerome Powell offered no major surprises on his second day of testimony before Congress and as investors waited for jobs data on Friday.

When Fed Chairman Powell stated that the Fed will probably need to raise interest rates more than anticipated in reaction to strong data, the USD/JPY appreciated. He further stated that if the data indicated that tougher steps were required to control inflation, the Fed would be ready to act in a manner that the market has interpreted as a 50bp hike. Therefore, up from about 22% prior to Powell’s speech on Tuesday, Fed funds futures traders now see a 70% chance of a 50 basis-point hike at the Fed’s March 21–22 meeting. The rate is now anticipated to reach its high in September at 5.69%.

The ADP National Employment report on Wednesday provided the most recent employment statistics, which revealed that private employment increased by 242,000 jobs in January while US job openings decreased less than anticipated. The previous month’s data were raised in the revision. This comes just before traders look for confirmation of continued strong job growth in the February Nonfarm Payrolls data, which is expected on Friday. According to the most recent statistics, employers created 517,000 new jobs in January. Markets anticipate 203,000 new positions in February, a 3.4% unemployment rate, and an unchanged 0.3% increase in hourly wages. Data on consumer price inflation released on Tuesday will be crucial in determining whether the Fed changes its approach to raising rates. Expected results indicate that costs increased by 0.4% in February.

USDJPY Analysis

USDJPY is moving in an ascending channel and the market has reached the higher low area of the channel.

Japanese GDP came in below expectations today for JPY buyers, printing at 0.10% as (QoQ) Q4 annualized versus 0.80% anticipated and the prior estimate of 0.60%.

The temporary news release caused the USDJPY to decline, and the Bank of Japan’s monetary policy continues to diverge from the goal of FED rate increases.

Following Federal Reserve Jerome Powell’s second day on Capitol Hill, the US dollar’s advance was halted, and USD/JPY is currently testing below 137.00 at the Tokyo start. Japanese GDP Annualised SA (QoQ) Q4 F: 0.1% (exp 0.8%; prev 0.6%), GDP SA (Q/Q) Q4 F: 0.0% (exp 0.2%; prev 0.2%), and GDP Nominal SA (QoQ) Q4 F: 1.2% (exp 1.3%; prev 1.3%), according to data recently published by the Cabinet Office. USD/JPY is down some 15 pips following the data while the US Dollar was otherwise steady in prior trade but down from three-month highs that were reached earlier on Wednesday after Federal Reserve Chairman Jerome Powell offered no major surprises on his second day of testimony before Congress and as investors waited for jobs data on Friday.

When Fed Chairman Powell stated that the Fed will probably need to raise interest rates more than anticipated in reaction to strong data, the USD/JPY appreciated. He further stated that if the data indicated that tougher steps were required to control inflation, the Fed would be ready to act in a manner that the market has interpreted as a 50bp hike. Therefore, up from about 22% prior to Powell’s speech on Tuesday, Fed funds futures traders now see a 70% chance of a 50 basis-point hike at the Fed’s March 21–22 meeting. The rate is now anticipated to reach its high in September at 5.69%.

The ADP National Employment report on Wednesday provided the most recent employment statistics, which revealed that private employment increased by 242,000 jobs in January while US job openings decreased less than anticipated. The previous month’s data were raised in the revision. This comes just before traders look for confirmation of continued strong job growth in the February Nonfarm Payrolls data, which is expected on Friday. According to the most recent statistics, employers created 517,000 new jobs in January. Markets anticipate 203,000 new positions in February, a 3.4% unemployment rate, and an unchanged 0.3% increase in hourly wages. Data on consumer price inflation released on Tuesday will be crucial in determining whether the Fed changes its approach to raising rates. Expected results indicate that costs increased by 0.4% in February.

GOLD Analysis

XAUUSD Gold price is moving in the Box pattern and the market has rebounded from the horizontal support area of the pattern.

After two days of major news from the US FED Committee on Testimony event, gold values are moving south. The only way to keep inflation under control, according to US FED Powell, is to raise interest rates more frequently and in succession. Therefore, there is a 75% chance that the FED Meeting will raise the 50 Basis points in March 2023. The labor market is still tight, and the unemployment number is the lowest it has been in five decades. As a result, non-yielding assets have an advantage over the US dollar, which has greater yielding potential than gold as a result of interest rate hikes.

Following yesterday’s selloff, gold prices stabilized in the early going of the European session as the $1800 psychological mark came back into focus. As a slew of US statistics and more remarks from Fed Chair Powell await, gold is aiming to continue its losing streak into a third day. As losses gathered momentum following Fed Chair Powell’s testimony before the Senate Committee in Washington, DC, gold prices have declined from their multi-week highs around $1856. The main conclusions were a higher peak rate and a possible increase in hike pace based on data. The likelihood of a rate increase of 50 basis points at the Fed’s March meeting has increased to 73.5% from 29.9% a week ago.

The markets will continue to be responsive to new data coming in from the US, if anything is still obvious. Prior to the blackout, Fed members have until Friday to release any additional comments. We will receive ADP employment statistics, import and export figures from the US, and more testimony from Fed Chair Powell later today. Looking ahead, the primary sources of attention will continue to be Friday’s NFP data and average hourly earnings. While markets are eager to learn whether last month’s NFP employment report was an anomaly or if we will see another significant print out of the US, average hourly earnings continue to be a major headache for the Fed in its efforts to control inflation.

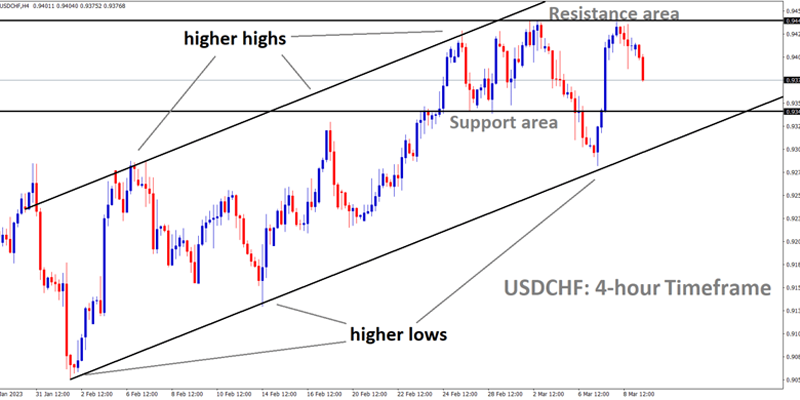

USDCHF Analysis

USDCHF is moving in an Ascending channel and the market has fallen from the resistance area of the minor Box pattern.

US President Joe Biden stated that corporate taxes will increase from 21% to 28% and that income over $400000 will be subject to a 39.6% government tax. These taxes will be used to cover the Medicare costs of employees who accumulate wealth over an extended period of time. This announcement helps the inflation figure to stabilize and reduces spending on goods.

Market reactions are changing as US President Joe Biden suggests increasing the corporation tax from 21% to 28%.Biden supports a 25% tax on billionaires and significant taxes against wealthy investors. and suggests a 39.6% budgetary tax on money over $400,000. In order for the millions of workers who contributed to the wealth to be able to retire with the Medicare they paid into, my budget will demand that the wealthy pay their fair portion.

USDCAD Analysis

USDCAD is moving in an Ascending channel and the market has reached the higher high area of the channel.

No rate adjustment was made following the Bank of Canada’s monetary policy meeting last night, keeping the cash rate at 4.50% as anticipated.

The governor of the Bank of Canada stated that because of the tight labor market and lower-than-expected inflation this year, our goal of 2-3% will soon be attained.

After the Bank of Canada kept its interest rate unchanged, USDCAD started to increase.

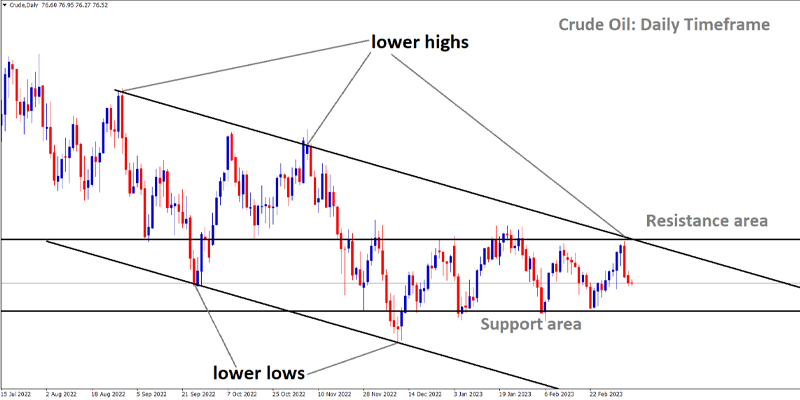

Crude oil Analysis

Crude oil price is moving in the Descending channel and the market has fallen from the lower high area of the channel.

The second meeting on monetary policy for 2023 at the Bank of Canada came to an end today. After increasing borrowing costs at each of its previous nine meetings, the organization headed by Tiff Macklem decided to maintain its benchmark interest rate at 4.50%, in line with expectations. In its statement, BoC said that the economy has evolved as anticipated, noting that the labor market continues to be very tight, and that inflation remains elevated, but underscored that CPI is expected to moderate and come down to around 3% in the middle of the year on the back of weaker growth in the coming quarters.

Regarding the prognosis for monetary policy, the bank reaffirmed its dovish stance, indicating that it will maintain borrowing costs at current levels if economic conditions evolve in a manner that is largely consistent with projections. This could indicate that the terminal rate has been attained, which would be bad news for the Canadian currency. The USD/CAD currency pair continued to advance after the central bank announced its decision, reaching a peak not seen since November 2022 close to the 1.3800 handle. The Canadian dollar is likely to display a bearish bias in the short term given that the Fed is hell-bent on extending its tightening campaign and that the BoC is on hold for the foreseeable future. This suggests that USD/CAD may shortly test its 2022 highs again.

EURUSD Analysis

EURUSD is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

Retail sales in Germany fell to -6.9% YoY in January from -6.4% the month before, and industrial output increased to 3.5% from 1.4% expected.

Employment change in the Eurozone fell to 0.30 % from 0.4% previously, and GDP came in at 1.8% YoY instead of the 1.9% forecast.

Due to the ECB’s policy actions, which have hinted at additional rate hikes, the outlook for the EUR/USD stays positive.

The EUR/USD currency pair battles to maintain its upward movement from a two-month low the day before, reaching 1.0550 in the early hours of Thursday. With no big surprises from central bankers and a light calendar, the major currency pair thus tracks the sluggish markets. It’s important to note that the mixed statistics from the US and the Eurozone, combined with the cautious atmosphere ahead of Friday’s important jobs report, have limited the recent movements of the Euro currency pair.

The recent suggestion by US Vice President Joe Biden to raise the corporation tax seems to be weighing on sentiment and teasing EUR/USD sellers. Despite this, there have been no significant changes on a wider front, and the S&P 500 Futures are still down 0.05 percent on the day. On Wednesday, German Industrial Production growth soared to 3.5% versus 1.4% expected and -2.4% previous readings, while Retail Sales growth accelerated to 3.5% versus 1.4% expected and -2.4% previous readings for January. (revised). Additionally, the seasonally adjusted Gross Domestic Product (GDP) decreased to 1.8% YoY during the said pair versus 1.9% expected and prior readings, while the Eurozone Employment Change eased to 0.3% QoQ during the fourth quarter (Q4) compared to 0.4% market estimates and prior readings. Ignazio Viscos, a member of the ECB Governing Council, stated in a statement on Wednesday that “monetary policy will have to remain prudent.” “Monetary policy should be guided by data as it becomes available,” the policymaker continued.

However, the US ADP Employment Change increased to 242K in February compared to 200K market expectations and 119K the month before. (revised). Additionally, the US Goods and Services Trade Balance decreased from the prior reading’s revised $-67.2 billion to the analysts’ estimated $-68.3 billion. The US JOLTS Job Openings for January increased to 10.824M from the predicted 10.6M but decreased from the previous revised estimate of 11.234M. It should be mentioned that the widest gap between the two-year and 10-year bond coupons has contributed to recession fears by driving up the benchmark US Treasury bond yields over the past three days. Jerome Powell, the head of the Federal Reserve, reiterated his conservative views in front of the House Financial Service Committee. The policymaker signaled that the Fed has underestimated the durability of growth and inflation while also highlighting the Fed’s data dependence. Before Friday’s US employment report, traders of the EUR/USD may find solace in the second-tier US job figures.

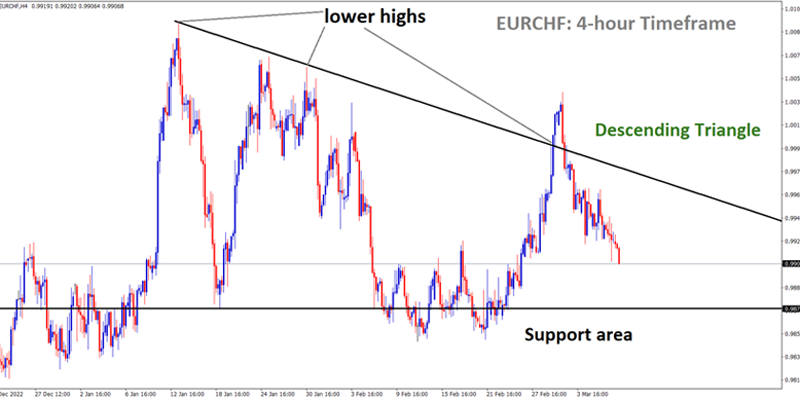

EURCHF Analysis

EURCHF is moving in the Descending triangle pattern and the market has fallen from the lower high area of the pattern.

Due to SNX intervention in FX to help with fighting inflation risks and selling Foreign currencies to fight against deflation risks, the Swiss Franc stays tightly correlated to the Euro. The Euro has lost value against the Swiss Franc as a result of the Eurozone’s weak first quarter development, while the Swiss Franc has gained value as inflation risks have decreased.

After initially strengthening from above parity versus the Euro in February, the Swiss Franc stayed in a comparatively narrow range. In the upcoming months, MUFG Bank economists anticipate that the pair will fluctuate just above 1.00.The risks of renewed CHF strength versus EUR appear to be higher in the near term, particularly if EUR/USD keeps moving back toward parity.

In addition to selling foreign currency that it had previously purchased to combat deflation threats, the SNB is using FX to help combat inflation. Because inflation declines will only have a minor effect on the weakening CHF, this is likely to persist, leading to an increase in Eurozone growth after a weak H1 and an improvement in overall risk sentiment.

GBPUSD Analysis

GBPUSD is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

UK Because the US President announced raising the taxes on billionaires from 21% to 28%, the US Dollar may be weaker in the markets. FED To combat the persistent inflation readings, Powell constantly tightened the monetary policy.UK It is anticipated that the manufacturing and industrial sectors will shrink by 0.10 and 0.20 percent, respectively. Due to weaker data printing in the factory and industrial sectors over the past few months, the Bank of England anticipated pausing rate increases.

In the Asian session, the GBP/USD pair is teetering close to the nearby support of 1.1850. To overcome the aforementioned obstacles, The Cable is getting stronger. The US Dollar Index (DXY), which is anticipated to maintain its lead before the release of the United States Nonfarm Payrolls (NFP) statistics, favors a return to the downside, though. The entire Wednesday’s gain in the S&P500 futures, which illustrates further strengthening of the risk-aversion motif, has been given up. The 10-year US Treasury yields are back above 3.98% thanks to investors’ poor risk appetite.

US stocks are under additional pressure as a result of the most recent headline regarding increased taxes on US billionaires and wealthy investors, a plan for the Budget that was backed by US President Joe Biden. Increasing the company tax from 21% to 28% is what US President Joe Biden has suggested. This could lead to a tightening of US fiscal policy, which would strongly support a reduction in US inflation. The publication of the US Nonfarm Payrolls (NFP) data will provide more clarity. Federal Reserve (Fed) chair Jerome Powell has without a doubt affirmed bigger rates and a higher terminal rate to strengthen its defense in the struggle against stubborn inflation. The payrolls are predicted to drop from the previous release of 514k to 203K in the economic statistics.

After the UK manufacturing sector data is released, the Pound Sterling may give a power-pack action. Industrial output and manufacturing production for the month of January are anticipated to decline by 0.1% and 0.2%, respectively. Investors need to be conscious that the UK manufacturing sector has continued to perform weakly over the past few months. This might compel the Bank of England (BoE) to temporarily halt the process of tightening monetary policy in order to assess the effects of the present monetary policy.

AUDUSD Analysis

AUDUSD is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

The CPI inflation rate in China was 1.0% in February, lower than the 1.9% forecast and 2.1% recorded in January. For the Australian Dollar relative to counter currencies, it is advantageous. The RBA’s slow rate increase pace is in greater contrast to the FED’s rapid rate hike pace.

As inflation data from Australia’s main customer China came in weaker for February, the AUD/USD reverses the previous day’s corrective bounce off a four-month low, accepting offers to refresh the intraday bottom near 0.6580. The risk-off mindset and hawkish Federal Reserve (Fed) wagers in contrast to the dovish tone of the Reserve Bank of Australia (RBA) Governor may be strengthening the downside bias. The Producer Price Index (PPI) also drops to -1.4% from -0.8% previous readings and -1.3% market consensus, while China’s headline Consumer Price Index (CPI) decreased to 1.0% YoY from 1.9% expected and 2.1% prior.

The AUD/USD price appears to be affected by both the depressing Chinese inflation data and the market’s risk-off sentiment, primarily because the pair is a risk barometer. It’s important to note that the US yield curve inversion maintains recession concerns while US President Joe Biden’s budget plan serves as an additional catalyst to affect sentiment and the AUD/USD exchange rate. Despite this, the benchmark US Treasury bond yields increased over the course of the last three days, and the prior day saw the biggest gap between the two-year and 10-year bond coupons since 1981.

In contrast, ahead of Friday’s budget release, US President Joe Biden suggests raising the company tax from 21% to 28%. In addition, Biden wants to impose a 25% tax on billionaires and high fees on wealthy investors. The recent market sentiment appears to be affected by a possible lack of acceptance and political chaos caused by the aforementioned budget plan. As a result, the S&P 500 Futures continue to end the day 0.05 percent lower and fail to trace any significant changes on a wider front.

The newest policy divergence between the Fed and the RBA, with Fed Chair Jerome Powell supporting higher rates and RBA Governor Philip Lowe indicating a policy pivot, is what primarily gives the AUD/USD bears hope. To provide more context for forecasting Friday’s top-tier employment statistics, the US Initial Jobless Claims for the week ended March 3 will join the Challenger Job Cuts for February. The AUD/USD bears may enjoy their trip if the scheduled employment numbers appear firmer.

NZDUSD Analysis

NZDUSD is moving in the Descending channel and the market has rebounded from the lower low area of the channel.

Today Non-farm payrolls are anticipated to be lower than the previous reading, and the FED appears poised to raise interest rates further in forthcoming meetings as a result of the tight labor market. More money is injected by the Chinese government as a result of the Chinese economy’s lower CPI printed, which benefits New Zealand exports.

In the Asian session, the NZD/USD pair was unable to retake the crucial support level of 0.6120. As news reports that US President Joe Biden has suggested raising corporation tax from 21% to 28% have further fueled unfavorable market sentiment, the Kiwi asset is falling toward the round-level support of 0.6100. US Biden favors a 25% tax on billionaires and significant taxes against wealthy investors. Additionally, he has included a 39.6% tax on revenue over $400,000 in the budget. The US budgetary policy appears to be in action to prevent the Consumer Price Index (CPI) from exercising its muscles even more. Higher taxation that reduce market liquidity could have a respectable effect on consumer spending.

The S&P500 futures are under duress as a result of the headline about taxing US wealth more heavily. In the Asian session, the 500-US stock basket futures are indicating losses. The market participants appear to be capitalizing on Wednesday’s minor recovery move as a buying chance. The US Biden plan for higher taxes may cause the US Dollar Index (DXY) to move upward. The USD Index is currently trading above 105.20 and is predicted to continue moving upward.

The US Nonfarm Payrolls (NFP) statistics will continue to be in the news this week. According to consensus, the US economy gained 203K new jobs in February, which is less than the previous record-breaking 517K. At 3.4%, the unemployment rate is thought to be stable. Investors would be concerned about statistics on average hourly earnings, which is predicted to rise to 4.8% annually from the previous release of 4.4%. The likelihood of the Federal Reserve raising interest rates further is increased by a rise in the labor cost index. (Fed). Investors are keeping an eye on China’s Consumer Price Index (CPI) statistics. China’s CPI is predicted to drop from its previous report of 2.1% to 1.9% on an annual basis. From the previous publication of 0.8%, the monthly CPI is probably going to drop to 0.2%. The Chinese government and People’s Bank of China may be forced to inject more money into the economy if inflation declines. It is important to remember that New Zealand is one of China’s top trading allies, and that a greater infusion of liquidity into the Chinese economy will increase demand for the New Zealand Dollar.